Article originally posted on YourInvestmentPropertyMag.com.au (YIP).

The federal government’s target of 1.2 million dwellings in the next 5 years requires an increased production capacity over and above what the industry is currently producing – will the new target lead to an increase in supply that affects house prices from rising?

The Housing Outlook

Right now, it is impossible to dispute that Australia is experiencing a chronic undersupply of housing.

House prices have recovered much faster than economists predicted, and rents have been increasing well above the long-term average. Not surprisingly, the federal government is considering all options to try to increase the supply of housing in the years ahead. Most recently, Anthony Albanese announced a national target of building 1.2 million new homes between July 2024 and July 2029.

This is an unprecedented goal.

In the 5 years to March 2023 Australia only produced 947,538 dwellings. The federal government’s target of 1.2 million dwellings in the next 5 years requires an increased production capacity of 26.6% over and above what the industry is currently producing.

If we look back a bit further, in the 5 years to December 2018, Australia actually built 1.1 million dwellings. So, the new target is only 9% higher than our previous record, which doesn’t seem so bad.

The million-dollar question for investors is: What happened after 2018 that caused our production capacity to drop, and will the new target lead to an increase in supply that affects house prices from rising?

Back to the Future

If you’ve ever seen the classic 1980’s movie trilogy, “Back to the Future”, then you no doubt appreciate the concept of having an unfair advantage by knowing what is going to happen in the future. As a teenager, I spent more than a few moments hoping that future-Matt might one day visit me in the “here and now” to tell me what the next five, 10 or 20 years had in store so that I could use that knowledge to make my fortune.

The reality is that predicting the future is a lot less “sciency” than you might think. In fact, it all comes down to understanding patterns, and knowing which patterns to look for.

When you throw a ball in the air you need to predict where the ball will be in a few moments time. Through repetition, you come to recognise the curvature of the ball’s path and quickly estimate the ball’s future position.

This is no different to what successful investors do to consistently achieve favourable returns from the property market. We are constantly watching the market, reading the patterns in order to judge the market’s future position. We look at the issues which affect the 4 Fundamentals of the Housing Market:

- Supply;

- Demand;

- Affordability; and

- Sentiment.

So, if you understand these fundamentals then you can predict where house prices will be in the next one to five years, giving you an unfair advantage in the market.

How to Manufacture a Supply Crisis

To understand the future trajectory, it’s important to understand what caused today’s supply crisis.

In 2016, Australia built 234,000 dwellings, which was a national record. This record number of dwellings was the result of a record number of apartments being completed, which was only possible because developers had secured pre-sales in 2014 and 2015 from a record number of foreign buyers and local investors.

Rather than celebrating this feat, state governments introduced new stamp duties and land taxes to scare away foreign buyers. The Victorian government also took away “off the plan” stamp duty concessions for property investors.

On top of the state government interventions the banking regulator, APRA, also wanted to reduce the proportion of property investors that were active in the market. They told banks to charge a premium to property investors, limit the rate of growth in property investor loans and try to shrink the proportion of investor lending relative to owner-occupiers.

Local governments seeking to improve the quality of apartments introduced tighter design standards which included larger balconies, more light wells, smaller building footprints and more carparks. These changes reduced the number of units each development could produce while also increasing the cost of construction.

Between 2016 and 2019, these changes made by local, state and federal governments made a high number of projects unprofitable. Of those remaining projects that were still profitable, many were unable to secure the pre-sales necessary to obtain bank funding. Without bank funding, projects become unviable and do not commence.

Facing such headwinds, the apartment sector contracted by 37% – from 27,000-unit commencements per quarter to 17,000-unit commencements per quarter.

When commencements drop, the labour market shrinks. So today there are fewer contractors and labourers available to build multi-unit developments.

A record pipeline

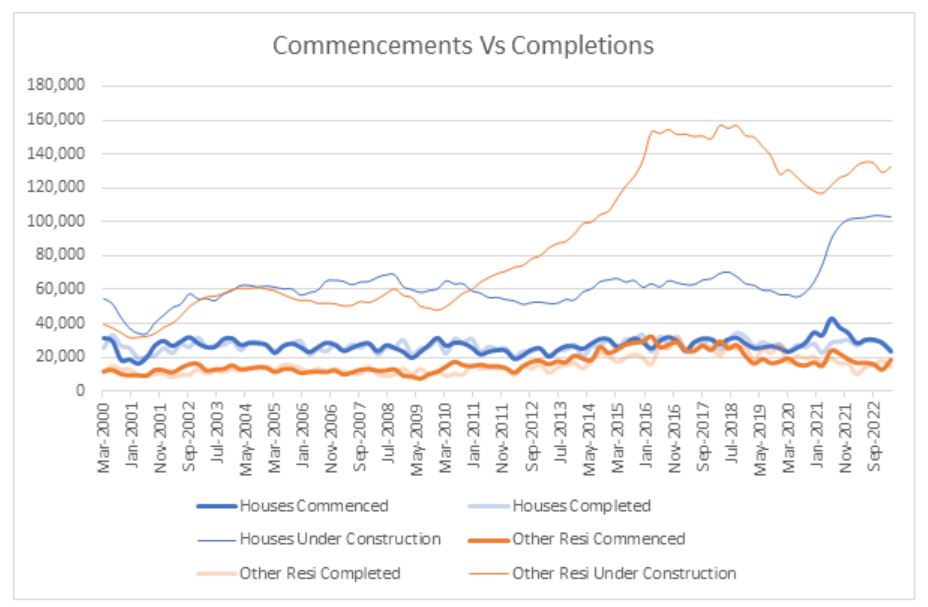

Today, thanks to the Homebuilder Grant in 2020, there is a record number of 240,000 dwellings under construction, including 100,000 detached houses.

Despite this, we are not seeing a record number of completions. This is because the time to build a house has more than doubled across Australia. The logical explanation for this is that:

- The Australian detached housing construction sector can only produce around 28,000 new homes per quarter;

- The “home building boom” between mid-2020 and late 2022 saw a peak of 42,000 new home commencements (which is 50% higher than the labour force capacity); and

- Covid supply chain delays and labour shrinkage, coupled with inflationary factors that caused bottlenecks in the construction process, further reduced the housing construction sector’s overall capacity.

As a result, there is likely to be only a steady flow of completed homes over the next 12 months that is in line with, or only slightly higher than, the long-term average for home completions.

At the same time, Australia is also experiencing a record immigration boom which saw our population grow by around 500,000 people in 2022. Therefore, the record pipeline of homes under construction is unlikely to dramatically increase the number of homes being completed and/or lead to a surplus of housing in the next 12-24 months.

What’s over the horizon?

Since May 2022, new home builders have faced a triple shock to affordability:

- Inflation pushed up the cost of building a new home by as much as 50% in some areas; and

- Interest rates increased from around 2.00% to 6.00%; and

- APRA increased the interest rate serviceability buffer from 2.00% to 3.00%.

Land developers have reported slower land sales over the last year and we are seeing detached housing approvals and commencements dropping consistently. In fact, new dwelling commencements are now sitting around decade lows. This suggests that from mid-2024 there will likely be a reduction in housing and multi-unit completions that will see Australia’s housing supply crisis worsen.

The government’s attempts to incentivise the States to increase housing supply through planning changes are noble and will undoubtedly benefit Australians in the years ahead, but it is unlikely to have an impact on the short-medium term.

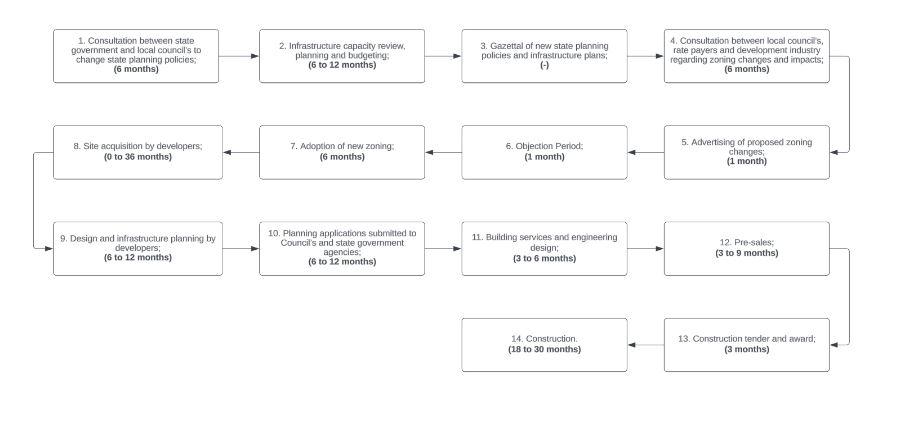

Planning changes take time to flow through. The following flowchart shows the typical steps involved in making major planning changes, which need to take into consideration the impacts on voters, landowners, businesses, existing and planned infrastructure and local governments:

Assuming the shortest possible pathway, it would take 65 months from start to finish, assuming that property developers already own every site that needs to be developed. Of course, the state could skip a few steps, but that would likely lead to confusion and fragmented delivery of new housing sites and projects.

But, the most critical point that is overlooked by the government, and which isn’t part of the planning pathway to increase supply, is the trifecta of constraints that they imposed on the developers in the first place. These constraints, which were noted earlier, made it virtually impossible for developers to sell off-the-plan following the 2016 housing boom:

- Increased foreign buyer stamp duties;

- Local investor’s lending constraints; and

- Uncertainty caused by regular and unpredictable lending policy changes.

If the government is able to address these, either through policy changes or by attracting institutional investors who may not need pre-sales, they are still faced with one major obstacle that is not so easily overcome: the size of the construction workforce.

As noted earlier in this article, Australia’s multi-unit construction capacity is now 37% lower than it was in 2016. Even then, the industry was stretched, and costs were escalating rapidly which resulted in many builder and developer insolvencies. To achieve the government’s target of 1.2 million homes in 5 years, at an average of 240,000 per year, we need to grow the construction workforce to be even larger than it was in 2016. This is all but impossible when competing against government infrastructure projects (Olympic Games projects coupled with the “Big Build” going on around the country) and the green energy transformation which is seeing public and private projects blowing budgets and construction delivery milestones.

The Future

Since I entered the property market in 1998, I have never seen the cards stacked in favour so much for property owners. Not only is there a housing supply shortage, but the constraints on new supply are going to be very difficult to overcome.

The only two things that are keeping a lid on the market right now are negative consumer sentiment and the interest rate buffer. For the last 12 months, property activity has been held back by the Reserve Bank and APRA, like water behind a dam wall.

All it will take is for one of these forces to soften and the dam wall will burst. When it does, expect a renewed and sustained house price boom that will not easily be overcome without government intervention which would make it practically impossible for the government to meet their housing targets.