Investing in property stands as a cornerstone of wealth accumulation for most Australians. However, when faced with the decision between paying off a mortgage and acquiring investment properties, the choice can be daunting.

Imagine this: you’ve worked hard to purchase your dream home, diligently making mortgage payments month after month. But as you sit in your cosy living room, you can’t shake the nagging question: should you focus on paying off your mortgage or venture into the world of property investment?

In this blog, we’ll delve into expert insights from Matthew Lewison and Michael Beresford to guide potential investors through this crucial decision-making process.

Factors to Consider When Deciding:

When considering whether to pay off your mortgage or invest in property, it’s essential to evaluate your individual circumstances and financial goals. While paying off your mortgage provides stability, investing in property offers the potential for long-term wealth accumulation. Some of the factors to consider are:

- Investment Horizon: Consider your timeframe and how long you plan to hold onto investment properties.

- Financial Goals: Conduct a thorough analysis of the costs and benefits associated with each option to determine which aligns best with your financial situation and where you want to be in the future.

- Cost-Benefit Analysis: Evaluate the financial implications of both options to determine the most suitable approach for your wealth creation strategy.

- Lifestyle Impact: Assess the impact on your lifestyle and whether sacrificing immediate expenses for mortgage repayment aligns with your priorities.

- Equity Utilisation: Explore the potential benefits of leveraging equity from existing properties to finance new investments.

- Market Conditions: Stay informed about current market trends and indicators to identify investment opportunities and potential risks.

- Risk Management: Consider the risks associated with using home equity for investment and how to mitigate them through proper financial structuring.

- Tax Implications: Evaluate the tax benefits associated with each option and how they may impact your overall financial strategy.

Utilising Equity for Investment:

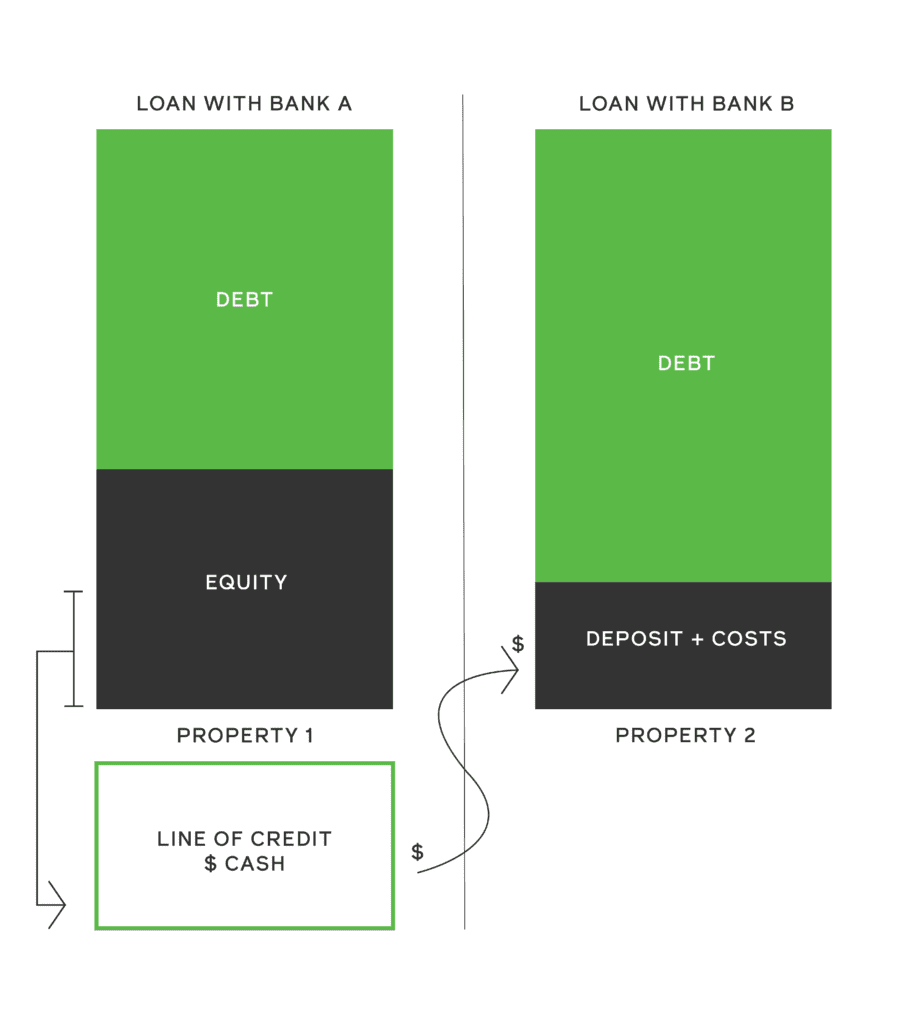

One strategy to accelerate wealth accumulation is leveraging equity from existing properties to finance new investments. For many homeowners, the idea of saving for a deposit for an investment property can seem daunting. However, Michael’s “lightbulb moment” highlights a fundamental truth: the only deposit you need to save for is the first one. Many homeowners may not realise that they already possess untapped potential within their existing properties. As property values appreciate over time, equity accumulates passively, waiting to be put to work. This realisation opens doors for aspiring investors, transforming homeowners into savvy property investors.

By strategically reinvesting equity, investors can maximise returns and expedite mortgage repayment. However, proper financial structuring is crucial to mitigate risks associated with cross-collateralisation.

Managing Risks and Separating Finances

The risk of using home equity for investment can be mitigated through careful financial planning. Michael emphasises the importance of separating financing for different properties to maintain control and minimise risks. By establishing equity lines and diversifying financing across multiple banks, investors can protect their principal place of residence while capitalising on investment opportunities.

We discuss the risks in property investment in our recent blog ‘The Risk and Reward of Owning Property.’ We also advise how you can set up your investment portfolio to help mitigate many of these risks.

Achieving Balance for Wealth Accumulation

Achieving a balance between stability through homeownership and growth through property investment is key. While paying off a mortgage offers peace of mind, investing in property provides opportunities for wealth accumulation. By striking a balance between stability and growth, investors can maximise wealth accumulation and achieve financial security through strategic property investment.

If you would like to understand how you can use property investment as a tool to pay off your mortgage in 10 years, not 30, check out our recent blog: Unlocking Property investment Potential: The power of equity

Ready to explore property investment as part of your wealth creation strategy? Schedule a personalised Strategy Session with our experts today!