We find and

secure the

best

investment

property for you.

With 20+ years of proven results and thousands of successful clients, we help everyday Australians invest in residential property the right way.

Why investors choose OpenCorp

#1

in Australia for

client results

$2B+

in client portfolio

value

19,000+

hours of annual research

20+

years of helping clients succeed

Personalised property investment

Just getting started?

We’ll show you how to avoid the traps most first-time investors fall into.

Short on time?

We take care of the strategy, research and setup so you won’t be left thinking, ‘I wish I started sooner.’

Sitting on lazy equity?

We’ll help you unlock the value in your home to fund your next investment, without overextending or putting your lifestyle or home at risk.

Want to use Super?

We’ll guide you through SMSF lending and help secure a smart property investment inside your fund.

Already own an investment property?

Renting but want to invest?

Rentvesting lets you live where you want and invest where it makes sense. We’ll show you how to make it work.

No more expensive mistakes, second-guessing or ‘I should have started 10 years ago’ regrets.

Most investors get stuck at one property

Most investors stop at one because they buy based on emotion, not a strategy built for growth. Poor suburb choices, the wrong finance structures and limited borrowing power often stall progress. We help you avoid these traps and set you up for long-term success.

Maximise your borrowing power

We structure your finance to keep your options open so you can buy again sooner, with less stress fewer roadblocks.

Leverage the value in your home

If you own a home, chances are you’ve built up value over time. We help you access that equity safely and use it to grow your portfolio.

Maintain lifestyle flexibility

You shouldn’t have to sacrifice your lifestyle to invest. Our strategies keep your cash flow strong so your property grows in the background while you live life on your terms.

Know when to invest again

Timing is everything. We don’t just help you buy, we help you know when to buy next. Your Portfolio Manager helps you time each move so you invest with confidence, not guesswork.

Ready to invest but not sure where to start? Fill in this form and you’ll be on your way.

"*" indicates required fields

The proven system that builds real wealth

There’s a reason our clients keep coming back. We’ve built a system that works. It’s simple, strategic and designed to grow your wealth safely, whether you’re just getting started or scaling your portfolio.

Before you think about property, you need a plan.

We tailor everything – finance, structure, and timing around your goals.

- Personalised planning: We map your path based on your lifestyle and long-term outcomes.

- Experienced mentors: You’ll partner with real investors who’ve done it all before.

- Proven roadmap: A step-by-step strategy designed to reduce risk and build momentum.

- Wealth focused: It’s not about the next property, it’s about building the life you want for you and your family.

Smart property selection -

driven by results, not opinions

We don’t follow hype. We follow data. Our 19,000+ hours of annual research ensure we find high-performing properties that align with your goals.

- Invest where growth is happening: Target markets with strong rental demand and long-term capital growth potential.

- Avoid suburbs that limit your ability to grow: We identify areas backed by data (not hype) so your property performs long-term.

- We don’t recommend anything we wouldn’t buy ourselves: Every property goes through the same process we use for our own portfolios.

Getting finance right isn’t optional

It’s mission-critical.

- Tailored structures: We match your finance to your investment strategy, not the other way around.

- Access to 70 lenders: More choice, better rates, less bank-runaround.

- Future-focused setup: Loans built to support your next move – not limit it.

- Cash flow optimisation: Pay less where it matters, grow more where it counts.

Property investment isn’t risky if you do it right.

Property investment isn’t risky if you do it right. Our job is to keep you safe while helping you grow.

- Rental Income guarantee: Backed by our tenant process, not blind luck.

- Data-led decisions: We only invest where the numbers stack up.

- Fixed price builds: No nasty surprises.

- Portfolio diversification: We help you spread your exposure across different markets.

- Financial buffers: Because playing the long game means preparing for the speed bumps.

Protecting returns

keeping tenants long-term.

- Maximised rental yields: Our focus is increasing your return, not just collecting rent.

- Quality tenants, always: Rigorous selection = better results.

- Proactive maintenance: We fix before it breaks.

- Truly hands-off: You won’t be dealing with weekend phone calls or missing paperwork.

Help to manage your portfolio

throughout your journey

As your portfolio grows, so does the complexity. We stay in your corner to keep it all aligned and working hard.

- Regular portfolio reviews: Know exactly where you stand and what your next step is.

- Cash flow monitoring: Ensure you’re maximising cash flow and investment-ready.

- Equity strategies: We help you unlock and use it – safely and smartly.

- Adapt when the market moves: No set-and-forget here. Your strategy evolves with your position.

We don’t follow hype.

We follow data.

Our 19,000+ hours of annual research ensure we find high-performing properties that align with your goals.

- Real insights, no B.S.: Learn from decades of hands-on experience, not recycled blog posts.

- Workshops & webinars: Hear it straight from our experts.

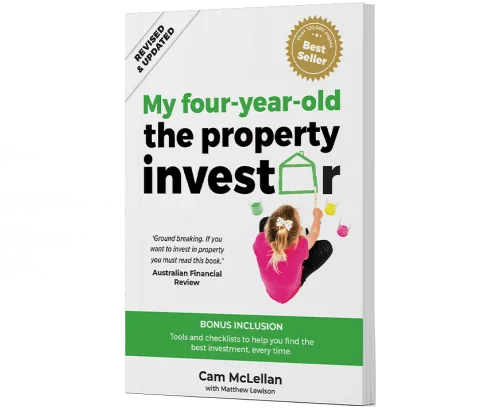

- Books & mini-guides: Learn the same system that built our portfolios.

- Investor podcasts: Stay sharp with on-the-go insights and real success stories.

- Exclusive investor community: You’re not doing this alone. Learn, connect and grow with like-minded investors

Real client stories

There’s no better proof than people who’ve done it. Hear from clients who started right where you are and used our strategy-first system to build long-term portfolios, avoid costly mistakes, and create real financial freedom.

Buying their first of 3 investment properties with OpenCorp, Michael and Talar tell all their friends and family; “We’d probably be retired by now if we’d started with OpenCorp 10 years earlier.

Kate turned past investing challenges into success. Her three properties now give her the freedom to plan retirement on her terms and the confidence to enjoy life without financial stress.

Some partners sell you a property. We help you build a portfolio

Most investors stop at one property, not because they lack ambition, but because they never get the right plan or guidance. At OpenCorp, we focus on long-term results, not quick wins.

Investing with OpenCorp

- Strategy-first, outcome-led

- 20+ years of proven results, thousands of portfolios

- Independently verified client results (ASIC-compliant)

- End-to-end support, done for you

- 19k+ hours of research, every year

- Mentors who are active investors

- Tailored plans that scale with you

- Built for long-term portfolio growth

- Clear process, ongoing support, no guesswork

Engaging another investment partner

- Property-first, limited planning

- Transactional scope, no long-term view

- No obligation to report client results

- No post-purchase help

- Inconsistent or surface-level analysis

- Advice based on opinion, not evidence

- Typically one-and-done. Zero accountability to result

- Limited strategy beyond purchase

- Once you buy, you’re on your own

Investing on your own

- Reactive, trial-and-error approach

- High risk of costly mistakes

- No portfolio tracking or benchmarks

- Overwhelming and time-consuming

- Little access to real market data

- No expert guidance or review

- No system to grow beyond one property

- No duplication plan or financial structure

- Uncertainty at every stage

The OpenCorp difference

A plan that starts with you

End-to-end support. No guesswork

Stay focused on your life while everything from finance, research to management is handled for you.

Decisions backed by real data

Smart structures that minimise risk

Protecting your borrowing power, minimise risk and keep future investment options open with smart finance structures.

Proven performance, results verified.

Proven through every market cycle

Join thousands of Australians who’ve used our system to build successful portfolios through booms, downturns, and everything in between.

Property news and insights.

Investing Insights

Ready to build your property portfolio with confidence?

Let’s map out where you are, where you want to go, and how property can get you there.