Investors who act now to get into the market and ride the wave of the market will be pleased with their decision, as opposed to those that sit around waiting for a bargain.

With recent data showing a broad-based recovery in the housing market, more and more people are asking me whether they should buy now or wait until the recovery has been running for a while longer.

The question brings to mind a story I read in Warren Buffett’s biography, which is a great lesson for every property investor.

Warren’s Story

In the earlier years of Warren’s investment career (i.e. when he was “merely” a millionaire, and not yet a billionaire) his wife, Susan, wanted to buy a new car. Knowing how frugal her husband was, she set her sights on a family car that was not flashy and would get the job done. She presented the idea to Warren hopefully, suggesting that they could easily afford the $15,000. To her surprise, he quickly told her that it would actually cost them $1 million.

Buffett knew that buying the car would reduce his investable cash by $15,000, thereby robbing him of the future returns on those funds. At the time, he was generating 30% per annum returns so he could turn that $15,000 into $1 million in just 15 years.

Buffett is now in his 90’s and has been a professional investor for more than 70 years. For the last 50 years he has averaged 22% per annum returns, so the $15,000 Warren invested rather than buying a car for his wife would actually be worth $1.5 billion today.

Warren Buffett knew the value of compound growth from a very young age. This meant, he understood the value of time in the market.

Australia’s Current Market

While it is comforting to buy in the middle of a boom, as opposed to buying at the start of a boom, the difference in compound returns is substantial.

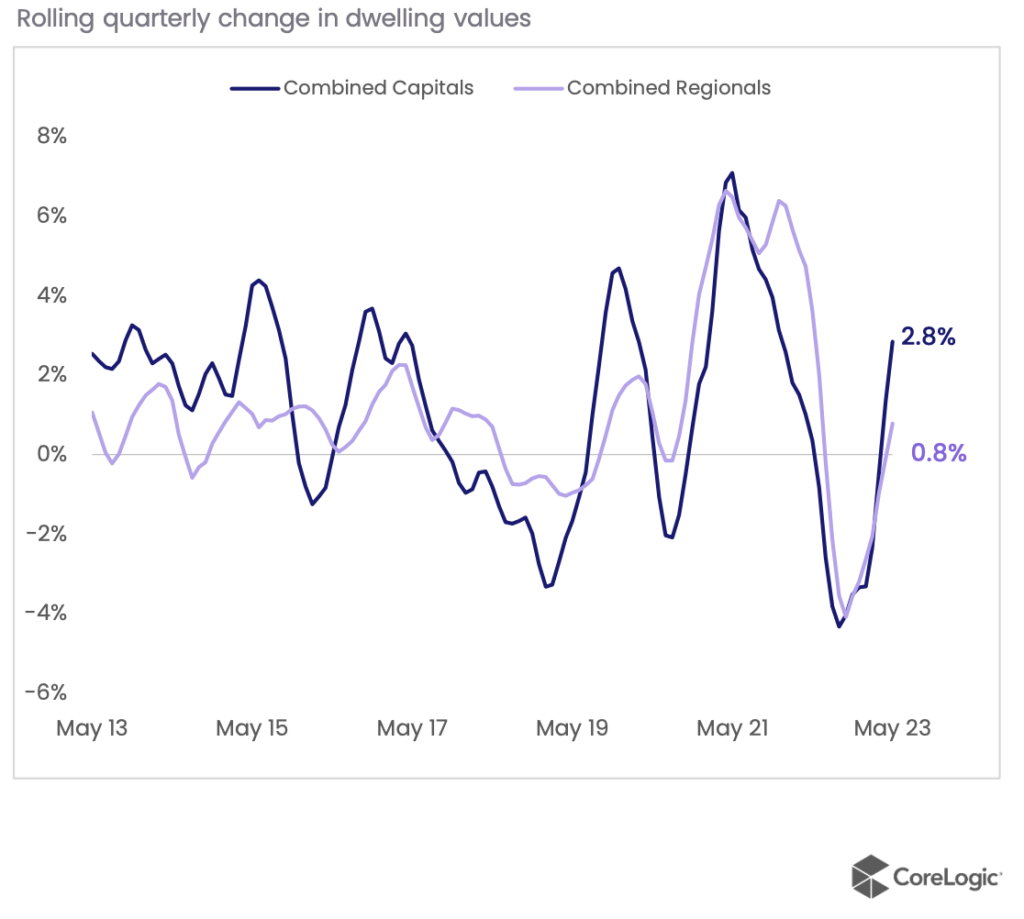

Since the start of this year, house prices in a number of capital cities around Australia have risen by more than 1% per month. On an annualised basis that is over 12%.

Investors that wait until the recovery are more pronounced risk paying more for an inferior property, relative to what they could buy today. Australia is in the midst of a housing supply crisis, which will not be overcome in the next 12 months, but as the recovery builds steam the pressure on prices will increase. This will make it harder to get good quality properties and prices will jump up quickly, hitting buyers with the double-whammy of a higher purchase price and higher stamp duties – which require larger deposits.

To put this in context, investing $120k today could improve your returns by more than $75k over 5 years compared to missing out on the first 10% of growth in this recovery phase. Due to compound growth, the differential would grow to more than $110k over 15 years – before factoring in the fact that a smart investor would use the extra equity to grow their portfolio faster by duplicating once they had seen 20% equity growth.

So, I have little doubt that in 20 years’ time the investors that act now to get into the market (or buy their next property) and ride the wave of the market will be pleased with their decision, as opposed to those that sit around waiting for a bargain.

I had the great fortune to have had a mentor who told me that there is no perfect time to invest, so the best time to invest is as soon as I could afford to. That is as true today as it was when I brought my first investment property.