Property Investors Need Foresight, not Hindsight

“Forget the headlines – follow the research-driven results” says Michael Beresford, OpenCorp’s Director of Investment Services

The housing market is very sentiment-driven, and one of the most influential sentiments is regret. Caution is no bad thing – but too much and you could miss out on a potential windfall.

At OpenCorp, we prefer foresight to hindsight, through intelligent, research-driven real estate investment strategies – and right now is your opportunity to leave regret behind forever.

So many clients tell me, ‘I wish I’d started investing in property in Australia 10 years ago’. We can’t change the past, but we can help you capitalise on the future.

We’ve been doing this for a long time, and our real estate investment strategy is underpinned by results – so we know when the market presents a great opportunity for significant price growth over the next five to 10 years.

Trust the successful property investment specialists

Not everyone takes their investing advice from seasoned, successful property investment specialists such as OpenCorp. Many people are swayed by media headlines – that’s natural, as we are emotional beings – but consider how those headlines flip-flop to support current themes (‘Housing Boom!’ one day, ‘Housing Crash!’ the next).

Back in 2014, I saw a headline in the national media, ‘Housing Bubble Fears – Property Prices Could Fall 10 to 20%’. If you were about to invest in property… well, you probably wouldn’t after reading that.

In 2017, RBA announced it was harder to borrow money and interest rates were increasing for investors relative to owner-occupiers (2017) – again, another deterrent.

And just recently I read one news outlet that ran polar-opposite headlines only 36 hours apart. That old chestnut!

Now, the property market I know doesn’t change every 36 hours, but we understand the media will sometimes sensationalise to get clicks. Remember headlines aren’t the whole story, but a way to draw the reader in, so dig a bit deeper, do some research and then make an informed decision.

If you want an exclusive, here it is: the market is poised to see accelerated and sustained value increases once consumer sentiment turns. So don’t waste this opportunity.

During COVID, we wrote a book, ‘Investing in the New Normal’, and everything we – as property investment specialists – predicted has happened regarding an undersupply and population growth.

Why do we get so passionate about this? Well, instead of shock headlines, listen to this one: three smart investing decisions in the past 10 years could have made you over a million dollars. That’s cold, hard fact – or cold, hard bricks and mortar.

These are actual suburbs and actual properties that OpenCorp clients invested in, based on our research-based recommendations.

Upper Kedron (Brisbane suburb) – purchased 2014

If you’d listened to the headline in 2014, you would’ve missed out on nearly $400,000 of profit.

Clyde North (Melbourne suburb) – purchased 2016

This was around the time it was becoming harder for investors to borrow (harder, but still possible). If you didn’t buy, you missed out on more than $300,000 profit.

Pallara (Brisbane suburb) – purchased 2020

During, COVID, we were talking to people about the opportunity. Clients who listened to us made upwards of $330,000 in less than four years.

| Suburb & Year | Purchase Price | Current Value | Profit |

| Upper Kedron 2014 | $499,500 | $890,000 | $390,500 |

| Clyde North 2016 | $461,500 | $770,000 | $308,500 |

| Pallara 2020 | $564,700 | $900,000 | $335,300 |

| Total | $1,034,300 |

Buying an investment property – the fundamentals

OK, so let’s have a look at where the market is at right now. There are four fundamentals:

- supply,

- demand,

- affordability, and

- consumer sentiment.

Once recent interest rate rises settle down, consumer sentiment and confidence will start to come back and the market will turn. We don’t have a crystal ball – but we’ve been doing this for a while.

You’d have to be hiding under a rock not to know that there’s a rental crisis going on – Australian capital cities have 14% fewer listings on the market than this time last year – which presents opportunity.

Demand at a basic level is population growth, and we know the government is committed to overseas migration – in 2024-2025, 235,000 forecast skilled migrants are coming to Australia.

(We also had significant population growth and skilled migration in the two years pre-COVID – 160,000 skilled migrants a year.)

So what that says is that there is very strong job creation that’s leading to wage growth, fuelling demand for housing because people need to live somewhere.

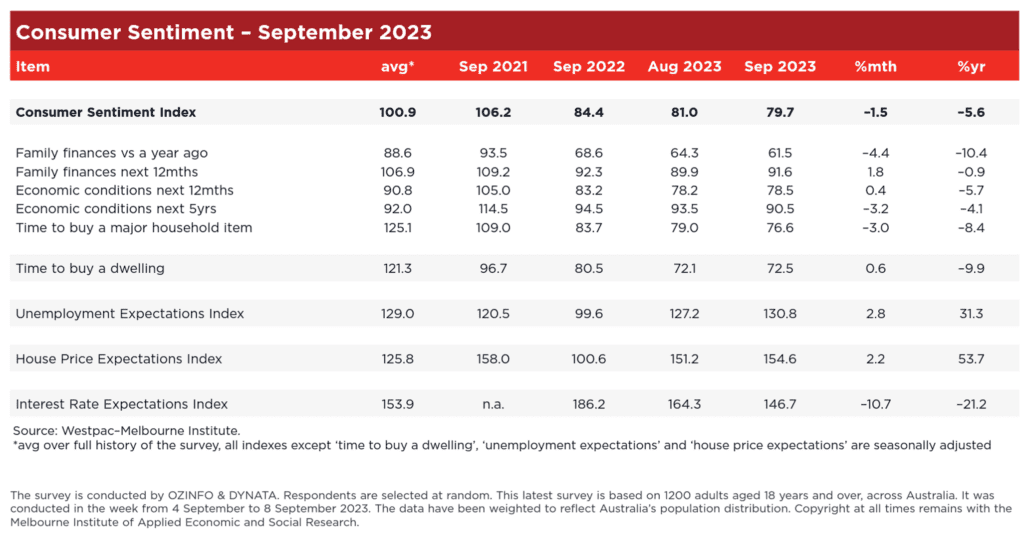

The ‘consumer sentiment handbrake’ explained

So we’ve got supply, demand and affordability all lining up perfectly – so why isn’t the real estate investment market going bananas?

Purely because of what we call the ‘consumer sentiment handbrake’.

In other words, how people are thinking and feeling, and once that starts to turn in a positive fashion, that’s when we see the market really take off and you’ll regret leaving it late for investing in a property.

KPMG recently said that over the next 12 to 18 months, house prices in Australia will increase 15%. The nuts and bolts of that report are the same fundamentals we’ve been talking about for 20 years. And what do you think happens when more of these stories are reported in the media, where people get their information?

You got it – they’ll start to follow where we’ve already been, and FOMO (fear of missing out) kicks in. So be smart and get in early to take advantage of that upswing in real estate investment property.

I encourage you to connect with us on social media (LinkedIn, Instagram, Facebook, YouTube) to gain market insights like this – we’re always putting out tidbits about property investment on our social channels. Our research and analytics team spend 19,000 hours a year scouring myriad data sources, and having conversations with key decision-makers to understand what their planning strategy is.

Connect with OpenCorp’s property investment consultants to stay across all of those updates.

When it comes to investing in a property (as the song goes): Regrets, I’ve had a few, but then again, too few to mention.