I’m often surprised by the variety of journeys that the people I meet take to achieve their goals. From the barista who serves my morning jolt to the friends I have made through sport, no two people have the same story. This is much the same as the world of property investors, which is far more diverse and closer to home than you’d imagine.

The Everyday Investor

Last week while doing a quick stop at the local coffee shop, I heard the barista telling one of the customers that she and her partner had just purchased their first investment property.

She reminded me of my early days: not quite sure whether she should be excited or nervous to now owe the bank hundreds of thousands of dollars. I wanted to jump into the conversation, but before I could congratulate her, the customer in front of me expressed her surprise that someone in their 20’s was buying investment properties while they were still renting in a share-house.

Now, this might come as a shock, but property investment isn’t the exclusive domain of the old and wealthy. It’s open to anyone with a dream and a dash of determination and there are many ways to achieve your goals. One of them just happens to be renting where you want to live and buying where you can make a profit from investing. In fact, this is exactly how I got into the market.

The Power of Starting Early

There’s a narrow window in our lives where diving into property investment truly lets you maximise your time in the market. Most people want to be debt-free and retire by the time they are 65, but the earlier we can achieve this the more flexibility and choice we will have in doing the things we love while we are still young enough to enjoy them.

Therefore, we only have a small window of at most 35 years to really make the most out of our property investments and the earlier you start the better off you will be in the long run.

My father introduced this concept to me through a simple exercise when I was still in primary school. He asked me how much money I would have if I could double my money every day for a month, start Starting with a 1 cent coin. I estimated that I might get to $10. So, has proposed that on the 1st of the month I write 1c on the calendar. Then, each morning I should double the value of the previous day and we would get to see what the total is after a month.

By day 30, that 1c investment had grown to over $2.5 million. It wasn’t just a fun math exercise; it showcased the remarkable power of compound growth over time.

This is why smart investors know that “time in the market” beats “timing the market”. Waiting, even a few years, can drastically reduce the benefits you reap.

The Silent Supporters

Getting started can sometimes take a leap of faith. It’s a lot easier when you have already made profits from property investing. Next best, is getting to watch first-hand as someone that you know, and trust achieve their investment goals. People whose parents, or close friends, have made profit from property investing often know that it works and just need a small amount of guidance to overcome their own fear.

One of the most exciting stories that I have heard recently came from my colleague Khaysan. She has been working with two siblings, fresh out of school at just 18 and 21, who, with the blessings of their parents, lived in the family home rent-free so that they could build their investment portfolio. Every dollar saved from rent flowed right into their first property investment. Within a few years, they were on their way, all thanks to the unspoken heroes – families who support dreams with actions, not just words.

We are also seeing more baby boomers using the wealth that they’ve accumulated over the years to support their children and grandchildren to acquire investment properties. Using equity from their assets, guaranteeing loans or co-investing in a property, enables the kids to benefit from their lazy equity while keeping it invested in a stable, low risk asset.

The High Achiever

For some people, investing is about growing wealth to escape the daily grind of work. Property enables people on moderate incomes to scale up their assets and helps to give them flexibility in the future.

For others, who earn high incomes (like doctors, lawyers, sportspeople, executives, tradies, business owners), property investing provides an opportunity to reduce tax and maximise their assets while creating a passive income for the future.

It’s Not Just About Bricks and Mortar

I had the good fortune of being able to watch my father’s confidence grow as he went from being a suburban sales rep to a successful property investor. I learned that property investing wasn’t about the houses. It was about the transformative journey and the safety net that comes from an asset base that consistently generates an income and grows in value.

I have met thousands of property investors, and only a handful have ever said that their investment goal was to be immensely wealthy. Everyone else had far more modest aspirations:

- To afford the best education/opportunities for their kids

- To have flexibility to live life on their own terms

- To escape the daily grind of the 9-5

- To know that they can support their families no matter what.

- To be comfortable in retirement and no rely on the pension.

Investors come from nearly all walks of life. So, the next time you’re having some friendly banter with a mate or sipping on your flat white at the local coffee shop, take a moment. You might just be in the company of a successful investor that has been quietly growing their portfolio for years, happy in the knowledge that they can do what they want, when they want, and don’t need a flashy car to prove it.

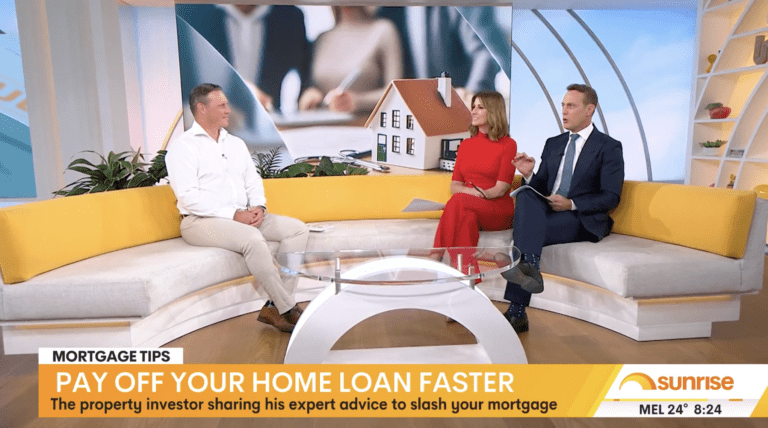

Ready to take the next step on your investing journey? Let’s have a chat, and who knows, you might be the next millionaire next door.