Originally posted on YourInvestmentPropertyMag.com.au (YIP).

“I just wanted to let you know that I’ve decided to sell all of my properties.”

Not the sort of thing you’d expected to hear from an avid property investor who started investing in 1984 and consistently added to their portfolio until they retired to focus on their (below average) golf swing in 2020. But that is exactly what my father told me last week.

This is the man whose biggest investing regret is not buying more property when he was in his 40’s, despite having built a portfolio that most Australians would envy. The same man who sympathised with borrowers earlier this year as they were being hit with rising interest costs, but who by his own admission would not curb his spending as he had no debt on his portfolio and had the good fortune to increase rents well below market to help his tenants with the cost of living.

It would surely take a lot to sway the guy that told everyone who had ever asked for his advice that, “the best time to buy is as soon as you can afford to, because you don’t know how long you’ll have before you can no longer afford to buy.” It turns out, it didn’t take much at all to motivate his decision, but I’ll get to that shortly.

The investor exodus

Recent media articles suggest that my dad isn’t the only investor thinking about selling, with headlines proclaiming:

- “Investor exodus threatens house prices” – AFR 21 July 2023

- “Reserve Bank drives investors out of the market” – MacroBusiness 27 June 2023

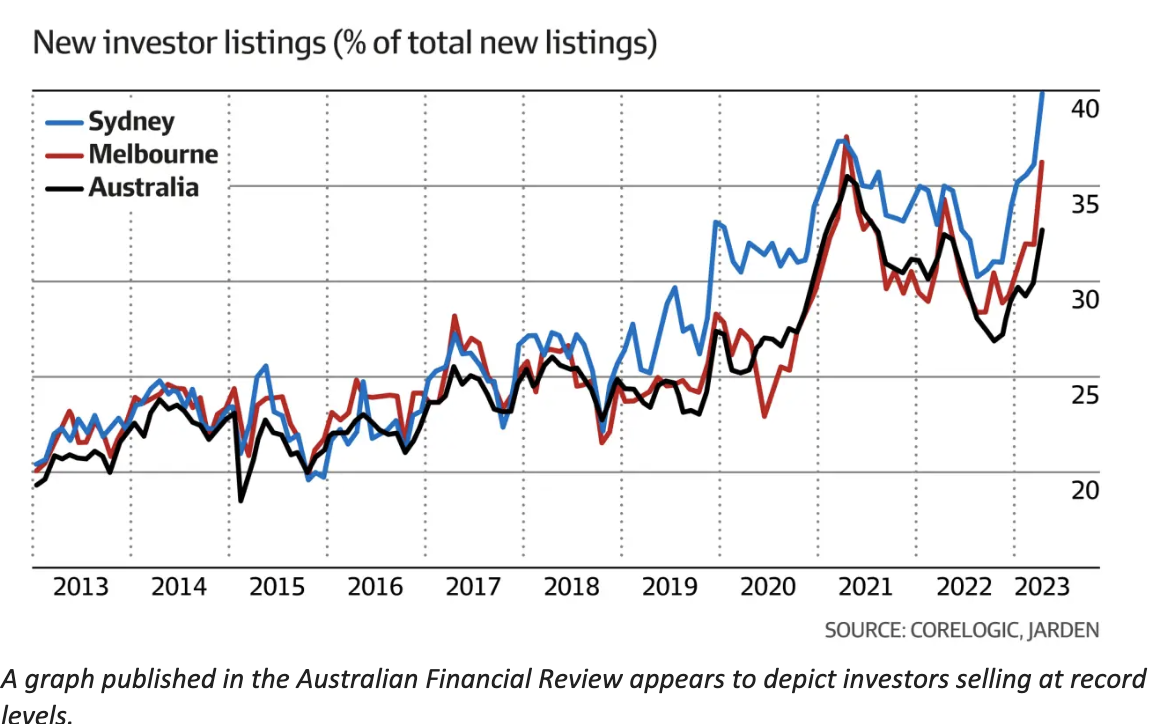

This is backed by fancy charts and expert opinions:

Dozens of articles reference the “record numbers of investors selling”. But statistics are often misrepresented by the media, so I decided to dig into this issue to cut through the spin.

The chart above shows only the percentage of sales where an investor is the vendor. It doesn’t show the total number of transactions instigated by an investor selling. In other words, we need further information to calculate this.

According to CoreLogic, who are credited with producing the above chart, on 30 June 2023 there were 132,058 property listings across Australia. This is 26.7% lower than the 5-year average of 180,160 property listings.

So, if approximately 33% of all listings today are property investors, then we’d estimate around 43,579 ex-investment property listings today. This is equal to just 24.2% of the average listings over the last 5 years. As can be seen in the above chart, new investor listings as a percentage of total listings have been comfortably above 25% for the last 5 years. We can infer from this that total investor listings today are not at record levels and have been higher, at various times, over the last 5 years.

But, if we put aside the obvious spin here, is there a trend emerging for people selling out of their investment portfolios – similar to my father – and will that have an impact on the housing market in the future?

The Baby Boomer Empire

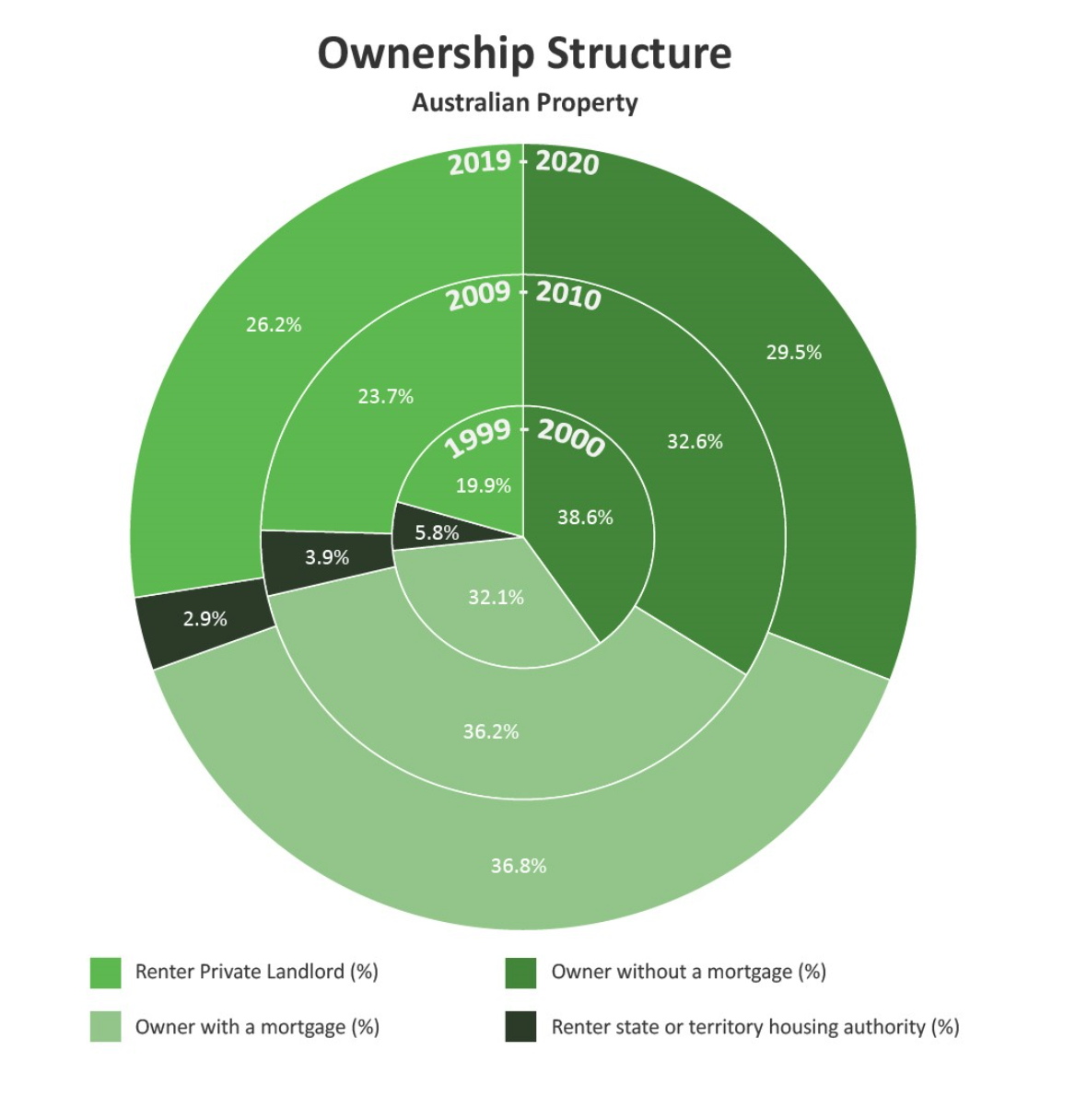

Housing tenure in Australia is broken down into 4 statistical categories by the ABS, as outlined below in a chart that shows the changes over the 20 years to 2020.

Source: Australian Bureau of Statistics, Housing Occupancy and Costs 2019-20 financial year

While the above chart shows that home ownership is diminishing, to the casual observer this data would suggest that roughly one-third of Australian homes are owned with no mortgage. This is not correct, due to the fact that rented properties may also have no debt.

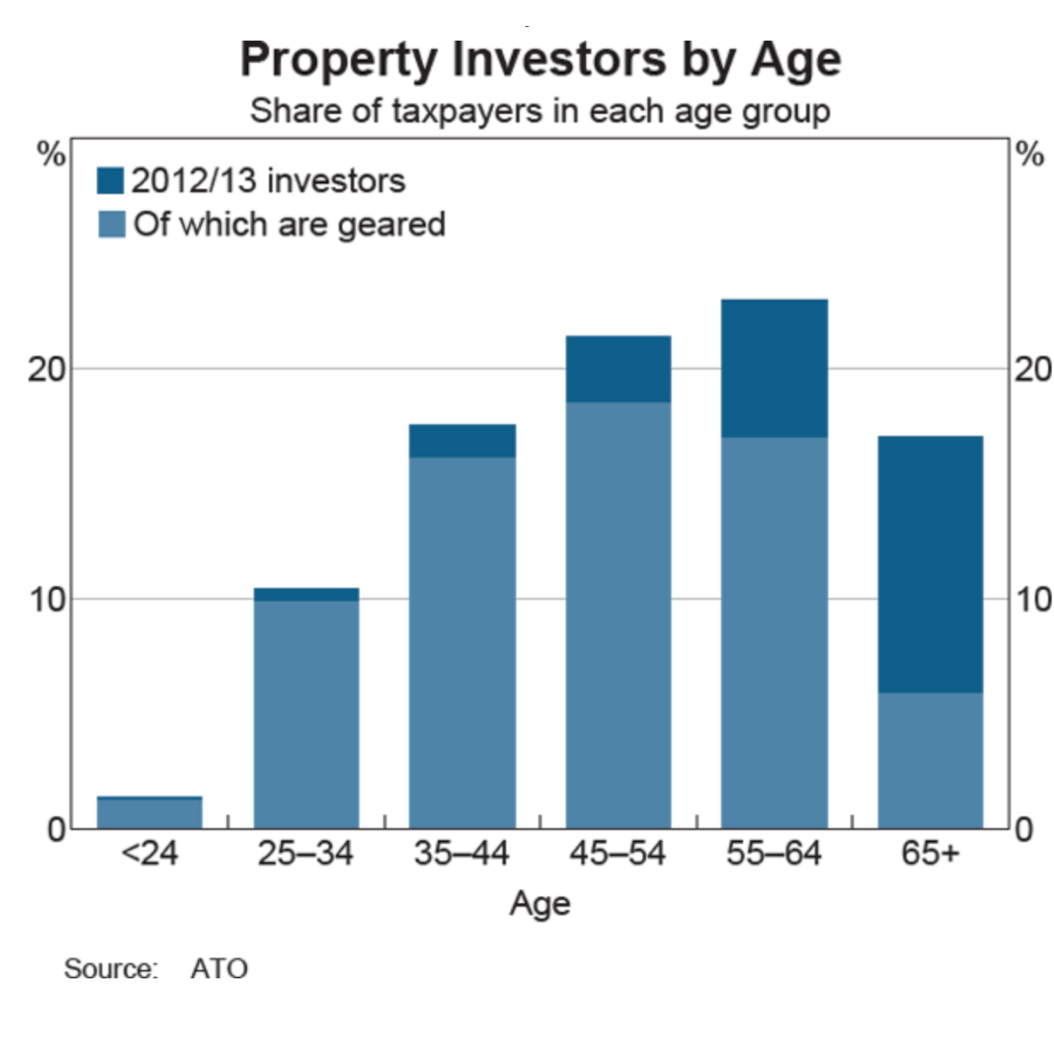

Property investors may be more likely to have a mortgage than an owner occupier, but their mortgage status depends on their age. Baby Boomers are more likely to own multiple investment properties due to the length of time that they have been growing their wealth and the fact that many of them would have also inherited property or cash from their parents if/when they passed away, enabling them to extinguish debt. Data from the ATO also indicates that a larger proportion of Baby Boomer investors have no debt relative to other property investors:

So, if so, many Baby Boomers have no mortgage on their PPOR and are debt free on their investment portfolio, why would they be selling up?

A Rush for the Exit, or an Exit Strategy?

According to research conducted by NSW Treasury in 2022 (“Holding periods of residential property buyers in NSW”), investors hold properties for an average of 8.8 years. So, it is logical that as Australia’s housing stock grows and the proportion of property investors is growing, the total number of properties being sold by investors will also continue to grow.

Over the last 5 years, we can clearly see that more investment properties have been sold than in the previous period. But these sales are being offset by an equivalent number of investors that are entering the market as working-age investors seek to build their portfolios. Furthermore, Australia’s population growth and growing share of renters ensure that there will be a constant and growing demand for investment properties in the coming years.

Nonetheless, as Baby Boomers (in particular) age, it is not unrealistic to assume that they will seek to sell out of their fixed assets. This will free up capital that they can use in retirement and should result in an orderly and consistent rate of transfers over the coming years. Investors that own multiple properties will seek to sell down over an extended period of time to minimise tax and maximise what they can reinvest in high-yielding investments.

Despite the grumbling and complaining about state government intervention making it too expensive and nerve-wracking to continue holding property as a landlord, the main reason my Dad is selling is to transition his wealth out of housing and into something that he can use in retirement or pass on to his grandchildren.

In fact, this strategy has been years in the marking. He spent the last decade clearing all of his debt using the Domino Effect (which is to pay off one investment property, then use the free cashflow to pay off the second, and so on at an ever-increasing pace until they are all debt free). He now plans to sell one house each financial year until he passes away, and we all hope that is still a long way off.

This strategy provides flexibility in tax planning and how Dad chooses to invest or spend the money that his property portfolio has generated for him and ensure that he can continue to generate a consistent rental income from his occupied portfolio until they are all sold.

My father is a very modest person, and he continues to be a great mentor to myself and many others whose lives have been transformed by his guidance over the years, but I do think he was perhaps a little bit premature in declaring his exit from the property market given that it is going to take more than a decade to complete.