Australia’s $21 Billion Surge and the Looming Slump

In the ever-evolving landscape of Australian property, headlines often serve as a veil, concealing intricate challenges. The recent revelation in the Australian Financial Review (AFR), titled “Australia’s $21b home building surge hides slump to come,” echoes sentiments I’ve been expressing for months. My regular analysis of the intricacies of the Australian housing shortage strongly aligns with the perspectives outlined in the AFR article. As we delve into the numbers and trends, it becomes clear that while the surge is a testament to industry resilience, it also uncovers a range of challenges demanding our attention and strategic foresight.

Navigating the Surge: A Closer Look at the Numbers

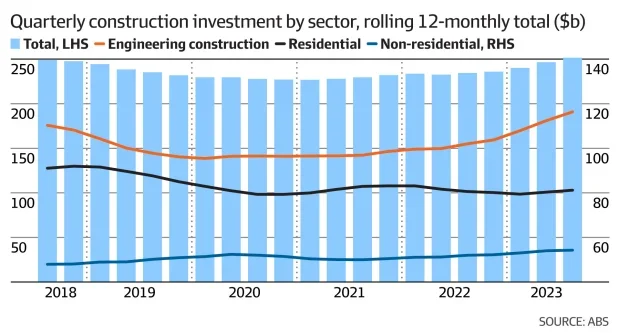

The AFR article highlights a notable surge in residential construction, boasting a $21 billion value in the third quarter. This seemingly positive figure, however, masks an imminent challenge – an impending slump in new housing construction exacerbated by rising costs, interest rates, and labour shortages. The construction industry faces multifaceted hurdles that demand closer analysis and possible strategic interventions.

To contextualise, the construction industry propelled a $20.7 billion surge, predominantly in detached home building. Delving into the figures, it becomes apparent that the surge is, in part, a result of delayed projects rather than sustainable growth. The AFR article reveals a concerning trend – a decline in new housing approvals over the last 17 months. This is something I have been talking about for the last few months, including in a recent article for Your Investment Property Magazine highlighting why the Government’s housing targets are unrealistic. Mitigating these challenges demands our proactive engagement and exploration of sustainable solutions to avoid a serious undersupply of housing in Australia in the future.

The Housing Market is at a Crossroads

In conclusion, Australia’s housing landscape stands at a crossroads. The surge in construction is commendable, yet it demands a discerning eye to navigate the challenges that lie ahead. The impending slump requires proactive measures, emphasising a diverse housing approach and sustained policy support. I advocate for a holistic and inclusive strategy to ensure the resilience and sustainability of Australia’s housing market.

In my opinion, the only way forward is to create more opportunities for investors to enter the market, providing additional properties for renters and helping to reduce the gap between supply and demand for housing in Australia.

As we navigate the intricate terrain of Australia’s property landscape, I find myself not just as the CEO of a property investment group, but as an avid investor, deeply entrenched in the Australian property market. The revelations within the AFR article have highlighted challenges, yes, but they have also cast a spotlight on unprecedented opportunities for those with the vision to see beyond the headlines.

As we stand on the cusp of a decline in supply, the demand has reached unprecedented levels – just glance at the tightening vacancy rates. In my years as an investor, I’ve seldom witnessed a more favourable landscape for those contemplating entry or expansion as a property investor.

As we move forward, let’s not just weather the challenges but embrace the opportunities they bring.