The simplest, but most important, lesson that I ever learned about investing was just 8 words long: “Time in the market, not ‘timing’ the market.”

It seems pretty straightforward, right?

The longer you invest, the more growth you can expect to achieve. The fewer risks you need to take. This means that the sooner you start investing, the more likely you are to achieve your goals.

But while the “time in the market” mantra is known to many, the vast majority of Australians set it aside and instead seek answers to the question, “When is the best time to buy property?”

If timing the market was easy, then there would be no such thing as a professional investor, and we could all do away with our Superannuation. You just need to look at how inaccurate the Reserve Bank of Australia has been with its forecasts, or the major bank’s economists predictions of 30% price falls that didn’t even come close to materialising in 2022, to get a sense for just how hard it is to pick the market.

That is why successful investors know that the best time to buy property is as soon as they can afford to.

This maximises their time “in” the market.

It enables the market forces such as population growth, constrained land supply, favourable tax settings, wage growth and the steadily increasing capital stock (ie. money supply) to do the heavy lifting for them.

When hopefully investors try to time the market, they instead find that they are confronted with conflicting views of the market outlook, negative media and messages from well-meaning friends, and uncertainty at every corner. These forces all conspire to keep them out of the market for longer. So, instead of making a windfall from a quick and easy win by “timing” the market to perfection, their goals are slowly but surely left to drift without any real progress.

For those that do understand and want to apply the approach of letting the market do the heavy lifting for them, the biggest challenge is saving a deposit and bank finance to buy their first property.

How to get started if you don’t have a deposit (or only a small deposit)

Since I started investing in property, I have read stories about people that buy property with “no money down”. While there are strategies that do enable this, it is very time-consuming to find a seller that is unsophisticated enough to agree to a sale where the buyer takes no risk at all.

The reality is, the more exotic the strategy, the more likely it is that it will cost you lots of money and time to learn and execute, both of which will slow you down from achieving your goal of breaking into the market.

Below are the simplest strategies that can be executed by just about anyone and take virtually no time at all to learn:

1. Co-investing

This is at the top of the list because this is exactly how I got into the property market when I was 18 years old. My brother and I were both living at home with very few expenses, and we saved up most of the money we earned from our part-time jobs so that we could each fund 50% of the deposit required to buy a property. We weren’t picky about the property: we just wanted something that we could afford.

At the time, the cheapest property we could find was $120k, and we each put in $12,500 which covered our share of the deposit and stamp duty. While neither of us could secure a loan on our own, being joint borrowers enabled us to tick the bank’s boxes to get on the property ladder.

While I’m sure the $120k price tag seems ridiculously cheap, remember this was 1998 and today’s property prices (2023) will seem cheap in comparison to the price of housing in 2048. After all, there is a good reason why “time in” the market is more important than “timing” the market.

2. Leveraging the “Bank of Mum and Dad”

Did you know that the baby boomer generation control most of Australia’s wealth? Boomers are more likely to own their own homes with no mortgage, and over the last 20 years, they have made a combined total of $4 trillion from the housing market.

In other words, there is a very strong possibility that your parents have done very well in the growth of the residential housing market.

What might surprise many people, is that the “Bank of Mum and Dad” – the term used to apply to the cohort of parents that lend money to their children – is one of the largest lenders in the country, with an outstanding loan balance of around $35 billion.

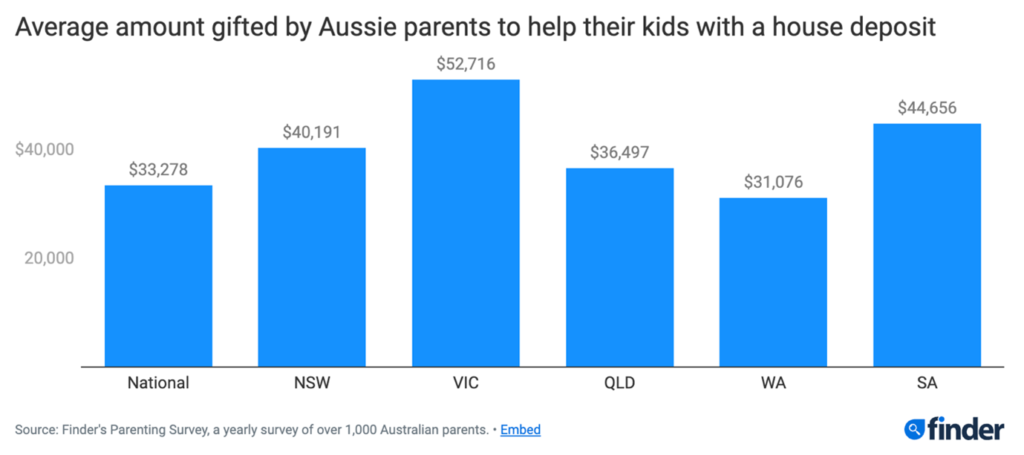

According to Finder, parents in Victoria are estimated to contribute an average of more than $50k to their kid’s deposits when they chip in.

But parents don’t need to provide cash to support your home ownership dreams. If your parents own their home and have significant equity, they can provide an equity gift or act as guarantors on your loan. By leveraging their equity and income, you can secure a deposit and embark on your property investment journey.

The key thing is knowing that many parents are pleased to be able to provide their kids with a pathway to home ownership. Once you understand this, then the question is: how do you raise the question?

While there is no one-size-fits-all approach, some options that have worked for many people include:

- Asking for a loan on commercial terms (ie. paying them interest)

- Offering them a share of the property (ie. you each share in the ownership of the house)

Often, by making it an investment prospect, people feel more comfortable about approaching their parents to ask for financial support and it is less confronting to think about the prospect of rejection.

3. ResiFund: Your Path to Property Ownership

Both co-investing and the Bank of Mum and Dad will typically require you to come up with a reasonable share of the deposit. The average time taken to save for a full deposit in Australia is now as much as 8.2 years in Sydney, so even contributing half will take around 4 years of saving. That’s a long time to wait if you are just starting to save.

Fortunately, there is now an option that enables you to start owning a property portfolio virtually instantly.

Designed for individuals who have cash savings ranging from $10,000 to $50,000 and want to grow their deposits by investing in the housing market, ResiFund is a residential property fund that offers a unique opportunity to gain exposure to the property market without the need to purchase a property outright.

4. How ResiFund Works

Similar to a managed fund, ResiFund allows you to invest in a diverse portfolio of residential properties across Australia. Experienced fund managers strategically select properties that align with the fund’s investment objectives. By acquiring units in ResiFund, you own a share of all the fund’s underlying investments and benefit from the fund’s capital growth and quarterly distributions.

5. Achieving Long-Term Growth

A number of ResiFund’s investors have already grown their deposits, starting with just $20,000 and adding to their investment through ResiFund’s regular savings plan, to enable them to enter the property market within a few short years. Their savings, coupled with the capital growth of the fund and the regular distributions, enabled them to cut down the time it took to save for a deposit by several years.

6. Seizing the Opportunity

Property markets move quickly, and timing is crucial. As the demand for housing continues to rise, rental prices are soaring, making it increasingly challenging for individuals to save for a deposit. At OpenCorp, we understand the urgency to seize the opportunity and not be left behind. That’s why we are proud to be the only company in Australia offering a specialist fund designed to support investors with as little as $10,000.

7. Explore Your Options with OpenCorp

If you’re on the cusp of saving for a deposit or are seeking strategies to bridge the gap and enter the property market, we invite you to connect with us. At OpenCorp, we offer limited opportunities for strategy sessions where our expert advisors can guide you and help you explore the best options for your unique circumstances. Don’t miss out on the chance to accelerate your property investment journey. Subscribe or apply for a strategy session today.

I was fortunate to have a father who could teach me the ins and outs of property investing. After jumping from job to job for 20 years, he changed his life by pursuing his dream of property investment. Seeing it first-hand gave me the confidence to follow in his footsteps.

But not everyone a parent who can show them the ropes (of property investing).

That’s why we are so passionate about sharing our knowledge with others. At OpenCorp, we believe that everyone should have an equal opportunity to invest in property and secure their financial future. By leveraging the “bank of mum and dad” or exploring our innovative ResiFund, you can overcome the hurdle of a deposit and enter the property market with confidence.

Feel free to reach out to us if you’d like to learn more about these strategies to grow your wealth. You might be surprised to find out how easy it is to unlock your path to property ownership.