Investing in property isn’t about picking a location and hoping for the best—it’s about understanding the market dynamics, data-driven insights, and long-term growth potential. If you’re considering property investment in Victoria, you’re in the right place.

You might have seen headlines predicting everything from interest rate hikes to market crashes. It’s no wonder people are confused. The media thrives on sensationalism, but as an investor, your decisions should be grounded in data, not fear. That’s where we come in. At OpenCorp, we pride ourselves on providing market-leading information before it hits the headlines, allowing our clients to make informed, strategic decisions.

Supply

- Land Constraints

- Vacancy Rates

- Dwelling Construction/Approvals

- Sales Listings

Demand

- Population Growth

- Overseas Migration

- Interstate Migration

- Jobs

One of the fundamental principles of property investment is supply and demand. Victoria is experiencing a massive influx of population growth, driven by record levels of net overseas migration. In 2023 alone, Victoria’s population grew by nearly 200,000 people (ABS 2023). This surge in population is not short-term, it’s a trend that is set to continue as the government leans on migration to bolster the economy. In fact, Melbourne is projected to overtake Sydney as Australia’s largest city by population by 2026 or shortly thereafter. This projection is based on recent population trends that show Melbourne growing faster than Sydney due to factors such as internal migration, international immigration, and a lower cost of living compared to Sydney (Dept of Treasury VIC) (Pinsent Masons).

What does this mean for you as an investor?

More people mean more demand for housing. With the current undersupply of properties, particularly in the rental market, this demand is only going to drive property values and rental yields higher.

Some investors might be frustrated that Melbourne’s property market has only grown by 11% over the last four years, especially when compared to the rapid growth seen in cities like Brisbane and Perth (CoreLogic 2024). But here’s the thing: Melbourne is primed for a significant upswing. While other markets may have already peaked, Melbourne’s median house prices are yet to hit their peak. This presents a unique opportunity to buy into a market that’s about to take off.

In fact, the fundamentals in Melbourne are so strong that selling now would be similar to selling in Brisbane back in 2019, just before it skyrocketed. If you hold on to your Melbourne properties, the rewards are likely to be significant in the coming years.

One of the key drivers of property value is infrastructure development. In Victoria, unprecedented government investment in major projects is set to vastly improve connectivity and accessibility, improving transport and job opportunities. This is laying the foundation for sustained growth in property values in the surrounding areas in key locations across the state.

The Victorian Government’s recent infrastructure investments by category, including approximate values:

- Roads and Highways – $3.54B

- Public Transport (Trains & Trams) – $1.59B

- Housing & Urban Development – $5.3B

Rental Market Realities

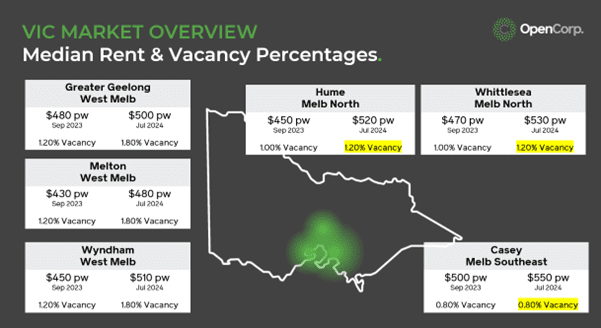

Victoria’s rental market is facing a crisis. There’s simply not enough supply to meet demand. Vacancy rates in some areas are as low as 0.8%, and rents are rising rapidly as a result (Domain, CoreLogic). For investors, this is a golden opportunity. While the media might report that rental growth is slowing, the reality is that rental yields are increasing off a larger base, meaning the dollar value of rent increases remains substantial.

The Melbourne Outlook

The Victorian property market is set to outperform over the next three to five years. With strong population growth, significant infrastructure development, and a rental market that’s crying out for more supply, all the indicators are flashing green. The only thing holding the market back right now is consumer sentiment—but once that shifts, as it inevitably will, we are going to see substantial price growth.

If you have already invested in Victoria, now is the time to hold firm and look at ways to maximise your portfolio’s potential. If you’re considering entering the market, there’s no better time to start planning your entry.

Interested in learning more about property investment in Victoria? Reach out to us for a personalised discovery call and find out how you can leverage these insights to successfully grow your portfolio.