Insights from OpenCorp’s Property Investment Strategist Kiran Khan

In this video, Kiran Khan, Senior Property Strategist, breaks down Australia’s house price history over the past 30 years. The pattern? Growth, corrections, and even stronger growth. With our current property shortage, falling vacancy rates, and rising rents, we’re anticipating a robust growth cycle in the near future. The media is even echoing major banks’ predictions: Expect strong house price growth and potential stability in interest rates

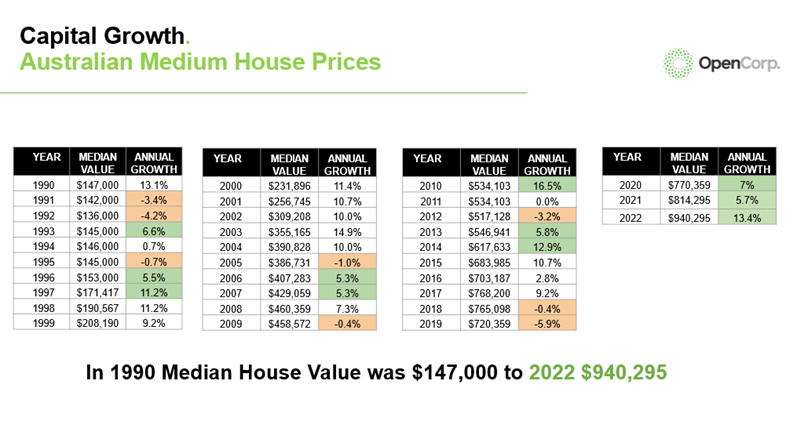

A Dive into the Historical Data

Recent data from CoreLogic highlighted some intriguing patterns:

- Post-COVID Spike: There was a significant surge in property values post-COVID. However, between May 2022 and February 2023, median house prices fell by 9.1%.

- Rebounding Market: As of February 2023, it appears the market has bottomed out, presenting an ideal window for investors.

- Historical Patterns: Over the last 30 years, Australian house prices have demonstrated a pattern – following a period of decline, there’s usually a robust phase of growth. And combined with the current housing shortage, declining vacancy rates, and rising rents this positions the market for a potential surge in median house prices. As sentiments shift, major banks forecast a promising period of house price growth, possibly coupled with decreased interest rates by next year’s end.

Key Takeaways

- Act Now: The best time to buy property was 20 years ago; the next best time is now.

- Market Insights: Pullbacks in the market are often succeeded by periods of robust growth. With the current housing shortage, it’s not a stretch to foresee rising median house prices in the near future.

- Informed Decisions: It’s crucial to buy the right type of property and maximize your income from it. There will always be areas that outperform and others that lag. Seek expert advice if unsure.

We are here to guide you through this journey. While not all regions will witness equal growth, our expertise ensures that the property you invest in is affordable, and primed for significant appreciation.