Land tax is a hot topic among property investors, and Victoria, in particular, has seen a wave of concern about rising costs. Land tax is a state-based tax levied on the value of land owned, it excludes any structures or improvements on the property (ie, a home). It applies to investment properties, holiday homes, commercial properties, and vacant land but does not apply to an individual’s principal place of residence (home they live in).

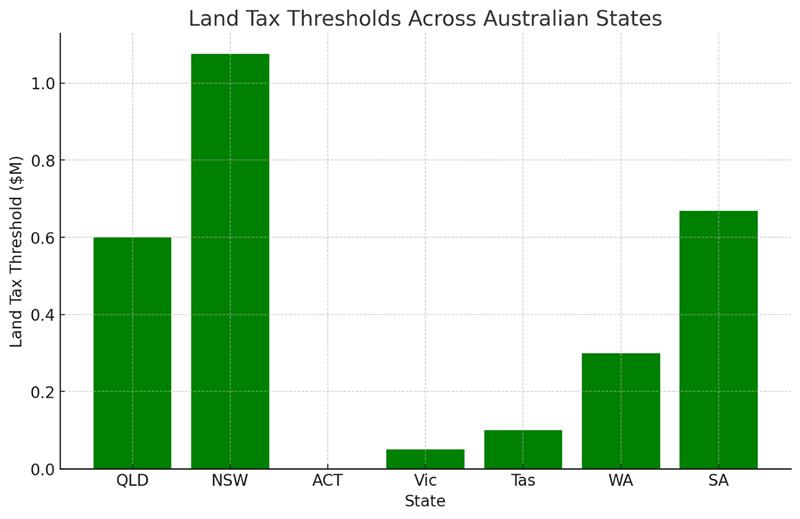

Each state and territory in Australia has its own land tax rates, thresholds, and exemptions, which means the amount payable varies depending on where the land is located and its total value. Investors and property owners should be aware of land tax obligations to avoid unexpected costs and ensure their investment strategy remains profitable.

Understanding Land Tax: A State-by-State Breakdown

While land tax is an expense, it’s one that can be managed strategically. Focusing exclusively on land tax would be a very short-sighted strategy, as land tax alone does not determine the holding costs or the future value of a property.

Victoria: Higher Land Tax, But a Thriving Market

Victoria’s land tax threshold was only adjusted in 2024. Prior to that, the threshold was higher, which means that you were not incurring land tax until the land value exceeded $300,000. In 2024, the threshold and the rates were adjusted by the state government in an effort to help balance the state’s budget. It is the change in land tax, rather than the total cost, that has raised the ire of many property owners. Here is a comparison of the old and new land tax rates:

| Old | New | |

| Land Value | $500,000 | $500,000 |

| Tax Free Threshold | $300,000 | $50,000 |

| Base Rate (when Tax free threshold exceeded) | $375 | $1,350 |

| Variable Rate (above Tax free threshold) | 0.2% | 0.3% |

| Total Land Tax | $775 | $2,850 |

So, for a property with land value worth $500,000, the increased land tax incurred would be $2,075. It’s understandable why existing property owners might be upset at what they see as a tax grab. But, for those that own property in Victoria and others that are considering investing in the state, it’s essential to consider the bigger picture—especially the rising rental market in Victoria.

Net Population & Rental Market Growth Offsets Costs

Victoria’s rental market is booming, mitigating the recent increase to land tax. Further, Victoria is on track to have the largest population of any state in the country. Smart investors that prioritise capital growth are already there in preparation for the oncoming boom.

- Victoria’s population has been growing at more than 100,000 people annually, significantly impacting housing demand. (ABS)

- Construction Costs and Approvals: In 2024, the cost of building a new home in Australia exceeded $500,000 for the first time, coinciding with almost 70,000 fewer new home approvals than the government’s target to alleviate the housing crisis. (ABS)

- 1.7% rentals vacancy rate (a market is considered ‘balanced’ at 3%). (CoreLogic January 2025)

- 10% rental price increase in 2024, with strong growth continuing into 2025. (OpenCorp average client rental portfolio increase 2024).

Rental Market Growth Offsets Costs:

For example:

- If your property was renting for $650 per week in January 2024, a 10% increase means you’ll earn an extra $3,380 annually.

- This is substantially more than the $2,075 increase in land tax. In fact, you would be $1,305 ahead on an annual base—a net gain! And, even better, it looks like 2025 will be another solid year for rental growth.

While land tax is a factor, strong rental demand and price growth continue to make Victoria a solid investment location. In fact, investor activity in Victoria is currently lower than in Queensland and NSW, which means those who invest now could benefit from ongoing rental shortages and increasing demand.

In Summary:

- People’s immediate reaction is to sell their investment.

- Smart investors who understand all factors involved stand to gain the most; they realise that the extra income through rental growth will exceed the extra cost of land tax.

- Historically, when land tax increases, investors sell which reduces the available rental pool, further driving rents up consistently well after the first year.

At OpenCorp, we dedicate over 19,000 hours a year to market research to ensure our clients make informed, profitable decisions. If you’re considering investing in Victoria, land tax shouldn’t deter you.

Have questions about property investment? Contact us and let’s build your strategy together!