At OpenCorp, we’re all about turning lazy equity into a powerhouse for building wealth. Let’s break down what lazy equity is and how you can use it to build your property portfolio – all while keeping your lifestyle intact!

Understand lazy equity with OpenCorp CEO, Cam McLellan, and Executive Director – Property & Investment Services, Michael Beresford, as they explain the concept of accessing lazy equity to build an investment portfolio.

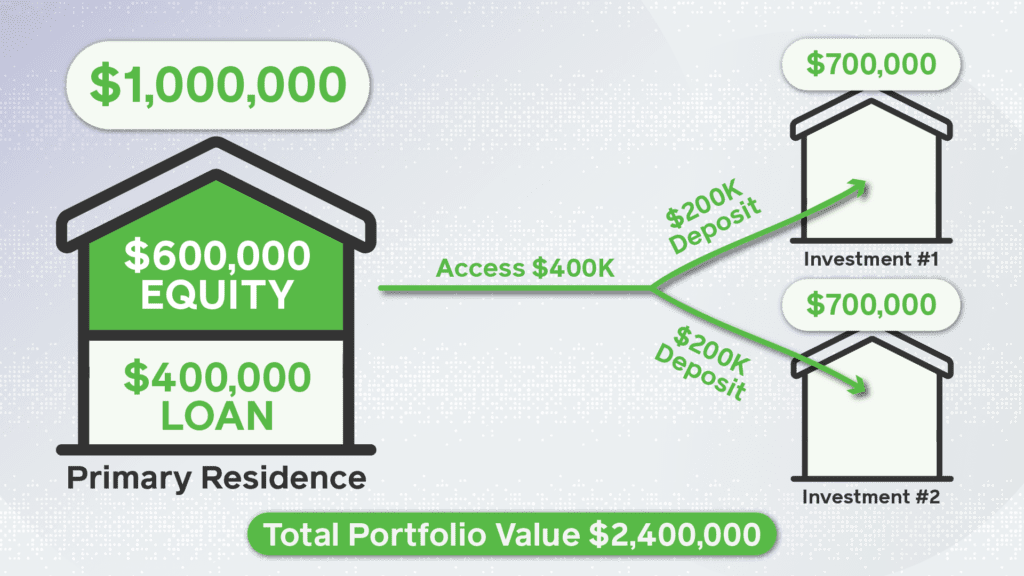

Lazy equity is the untapped potential in your property—the difference between your property’s current market value and what you owe on it. For instance, let’s say your house is worth $1M, and you’ve got a $500,000 loan. The bank is generally happy to lend you up to 90% of the property’s value. So, the difference between your current loan and what the bank will allow you to borrow is $400,000—that’s your lazy equity.

How to Make Lazy Equity Work for You

You can leverage equity to fund the purchase of an investment property—without dipping into your savings. Here’s how:

- Leverage Smartly: Considering the above scenario, as an example, access $400,000 in lazy equity, in your current property asset. Instead of just letting it sit there, you can borrow against it. In this example you could pull out $200,000 to cover a 20% deposit and other purchasing costs for a new property. Using equity this way, you can grow your property portfolio. No out-of-pocket expenses or tapping into cash savings that could have an impact on your current lifestyle.

- Cover all Bases with Equity: Planning to build new? There’s a period where you’ll be paying interest on the construction loan before the property starts earning rental income. This is where people often slip up—they forget about those interest payments. To avoid this, build in an extra buffer when you set up your equity loan. For example, if you think you’ll need $150,000, set up a line of credit for $175,000. That extra $25,000 can cover the interest during construction, so you’re not out of pocket while waiting for tenants to move in.

- Get the Right Team: You shouldn’t rely on a regular home loan broker for your investment needs. At OpenCorp, we help our clients secure the optimum loan structure to access their equity. Being property investment focussed, we understand solutions that minimise risks and maximise your returns – and how to structure your loans so you’re not caught short.

We’ve seen firsthand how turning lazy equity into a powerful investment vehicle has transformed our client’s lives.

If you’d like to discuss your personal situation and explore your options for leveraging equity and building long-term wealth, book a discovery call with one of our investment experts today!