If some media articles were to be believed, the sky is falling in on us.

The media like to focus on a headline that is going to grab attention. They focus on one variable, and ignore the fundamentals. When was the last time the media had a positive headline? Some headlines at the start of Covid, speculated a 30% drop in property values. Then, when that didn’t come to pass and prices increased by 30%, the media turned its attention to the difficulty in saving for a deposit and the lack of affordability for first-home buyers. Next came the election and the fear-mongering that comes with it, closely followed by hysteria around inflation and the impending interest rate rises.

It’s tough to make decisions in an environment where we are bombarded daily with negative news.

For investors, the media noise is always there but it’s important that we look through this to the fundamentals that affect the market, not the headlines.

The reality is, property prices didn’t fell – they increased by 30%. But at no time was there a discussion about the lack of supply of Australian property and the factors that drive price growth and rental increases.

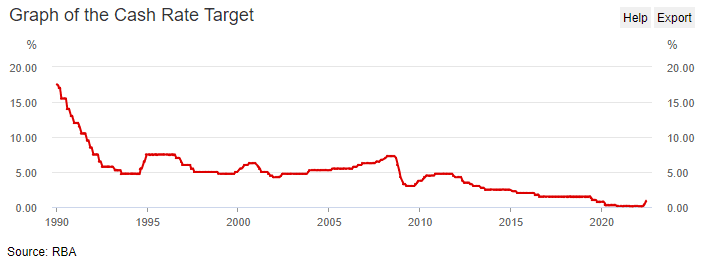

Interest rates have gone up due to inflation increasing at the highest rate in decades. The RBA are trying to limit inflation, and have decided to increase the cash rate to .85%. This is designed to have a cooling effect on spending, as the cost of mortgages increases. There’s a high probability that there will be more interest rate rises in 2022.

It’s important to look at why inflation has increased to understand what it means for the property market.

The situation in Ukraine has driven up energy prices. The recent and ongoing natural disasters in Australia, and other food producing nations have meant the supply of food has been reduced, increasing costs. Major cities across China, which produces building materials and consumer goods that the rest of the world consumes, has been in Covid-induced lockdowns for much of the last 6 months and has been producing far below their usual output, increasing scarcity of many products.

These situations are not permanent and so inflation will likely abate to more reasonable levels. This should mean that excessive rate increases will not be necessary. Keep in mind, only 6 months ago the RBA was suggesting that low-interest rates were here to stay until well into 2023. The media tends to focus on the current issue and portray it as a permanent trend that is unstoppable. “Unstoppable” is far more enticing to readers than “somewhat more elevated than normal”.

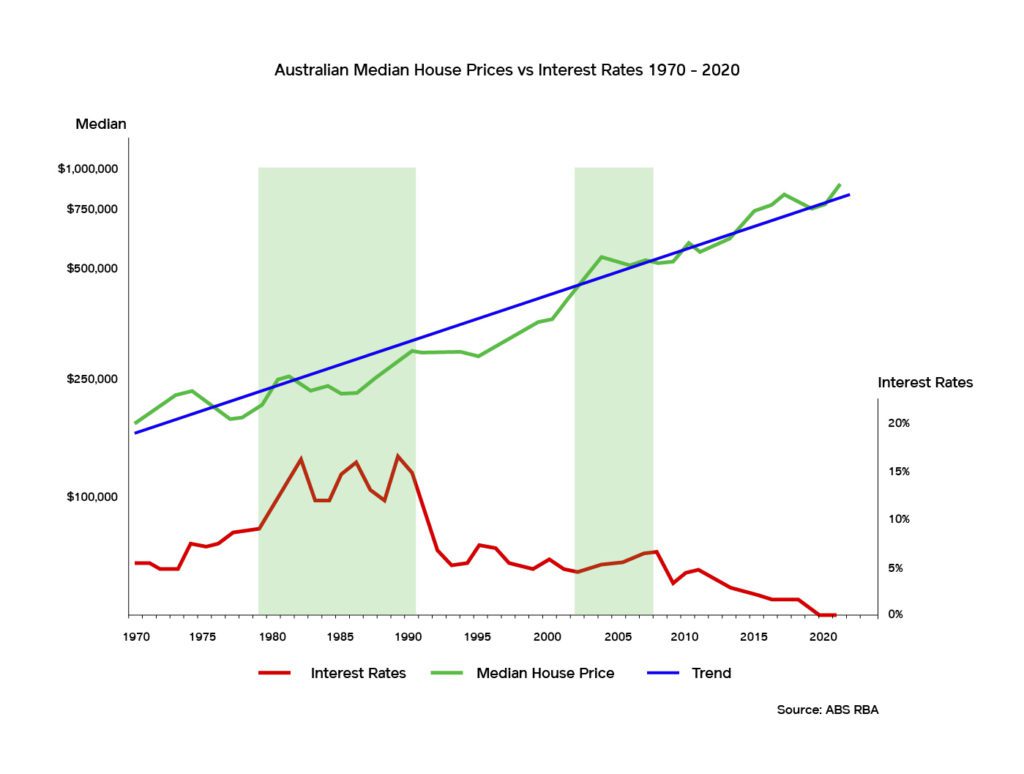

Interest rate rises in Australia have not correlated with drops in property prices historically. It may contradict what is presented in the media headlines, by journalists who are typically not economists or professional investors, but inflation generally causes house prices to rise faster.

A great example of this, is in the late 80’s, when interest rates were at 16-17%, property prices grew by 160% in Melbourne, and higher in some other capital cities. Again in the early 2000’s, interest rates rose as did property prices. Interest rates rise due to growth in driving factors such as wages, low unemployment, and a strong economy. As interest rates increase, so do rents, and property prices.

While some media headlines are doom and gloom around these recent interest rate increases, its important to look back at the history of cash rates in Australia. Data is a far better educator than a newspaper columnist who is trying to sell newspapers. Data has no bias.

They average around 5%, the current cash rate is at .85% which is still historically low.

Unemployment is at historically low rates, currently 3.9%. Such is the demand for workers, the government is increasing the skilled migration rate and wages are increasing well above the average of the last 15 years.

Property investors should be aware that interest rate rises will influence the property market. The more expensive a suburb is over the median house price, the more likely they will experience a drop in the median house price in that suburb. More affordable properties and suburbs, that are at or below the median value for the capital city, will continue to grow in value. This is called a ‘bottom up’ market, which is driven by a shortage of supply relative to demand.

Increasing borrowing costs does affect what people can afford to spend, but when there is housing scarcity, as there was in the 1980’s, people are forced to buy regardless of the cost or otherwise perpetually rapidly escalating rents. Buying actually fixes your costs, whereas renting exposes you to further cost increases.

Higher paid people that might have brought in the inner city, start to shift their intentions to the next suburb out. That trend continues to the outer suburbs, which are most affordable but the people who would have brought in these affordable suburbs now have more competition. As a result, these suburbs become some of the most hotly contested, because there is no “second best option” – particularly when the cost of construction is rising.

Now, we should point out, as it hasn’t been reported on widely yet, but there is a rental crisis in Australia’s capital cities. That is only going to get worse with the onset of international migration which will further increase demand. The fundamentals of what drive property prices are very strong. There is very limited supply in Australia currently, and that is unlikely to change in the short term due to material and labour shortages. The demand is high.

Whilst the property market is strong, it is more important than ever to buy the right property, in the right area, in the right market. One $500,000 mistake can add years onto your goals. Take advantage of the opportunities that present themselves and ignore the headlines designed to sell clicks.