…why their strategy is failing tenants while not having the impact they intended.

The Reserve Bank of Australia (RBA) has increased interest rates for the 12th time in around 13 months. This has significant implications for borrowers and the overall economy. Let’s cut through the misinformation and look at the underlying factors driving this decision and why their strategy is failing property investors and tenants. We also propose solutions that we welcome your feedback here.

RBA’s Objectives and Strategy

The RBA’s primary objectives are to maintain currency stability, ensure full employment, and promote economic prosperity. By increasing interest rates, the RBA intends to encourage households to tighten their budgets, reduce demand, and lower prices, thereby controlling inflation. However, the question remains: Is this strategy effective?

Impact Inflation: Housing & Transport

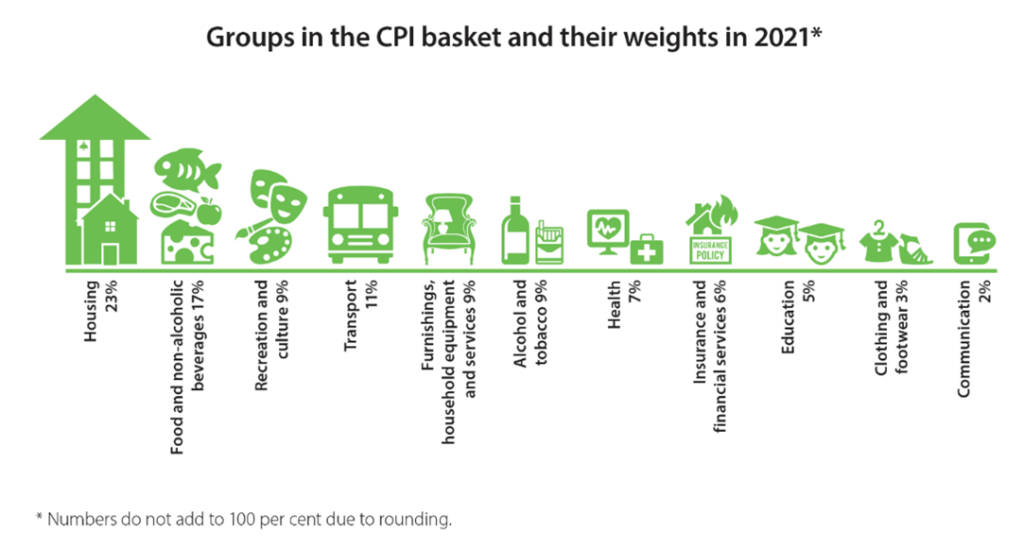

Inflation is measured using the Consumer Price Index (CPI): CPI is a measure of a range of household goods, with housing being the largest component in the household basket.

Housing

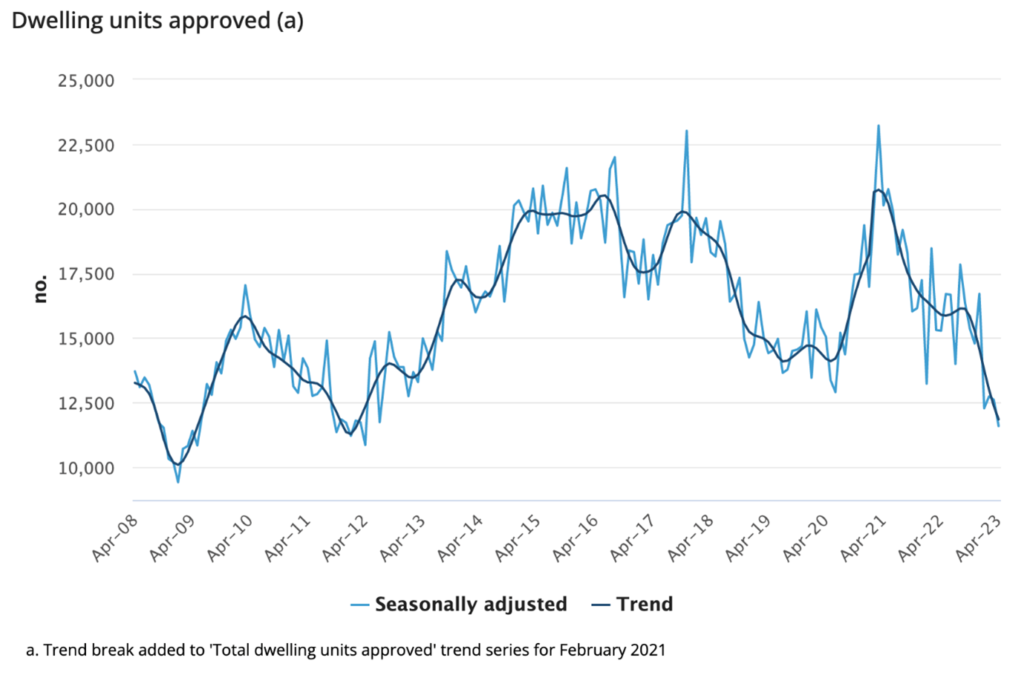

One unfortunate consequence of rising interest rates is a decline in dwelling approvals and new housing construction. Since interest rate hikes there has been a significant decline in dwelling approvals and new home construction. This reduction in housing supply contributes to inflationary pressures, particularly in the rental market leading to higher rental prices.

- Dwelling approvals dropped by 4,000 fewer approvals per month (compared with 6 months prior to interest rates going up).

- 30,000 fewer homes constructed on last 12 month. We are on track to build 48,000 fewer homes in next 12 months.

Is RBA Strategy working? NO, it is not working as its resulting in fewer homes being built which is driving up rentals. Regardless of interest rates people still need homes.

Transport

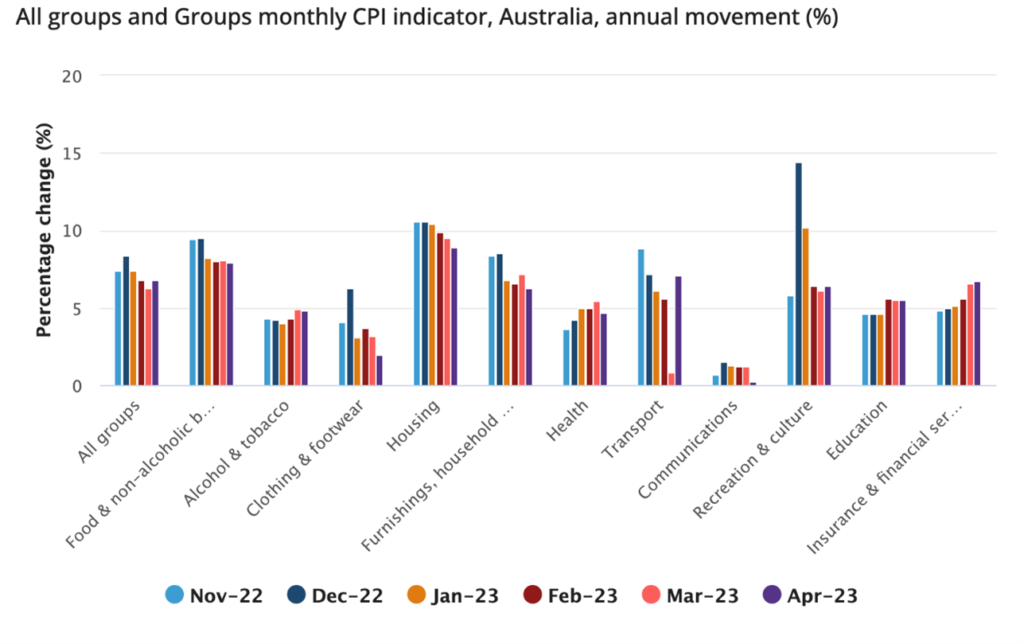

When we excluded items that tend to fluctuate in price such as volatile items the inflation rate actually decreased. The prices of most goods in the basket remained steady, except for transport costs, mainly fuel which had a noticeable impact on overall inflation rate. However, if we remove transport costs from the calculation, inflation would have gone down. It’s worth noting that transport costs can vary, but they have not increased compared to the same period last year. As for housing costs, particularly construction costs, they are rising at a slower rate, currently around 5% per year.

Inflation actually went down if you exclude volatile items such as Transport (petrol costs) which will always go up and down.

Rental Market Challenges

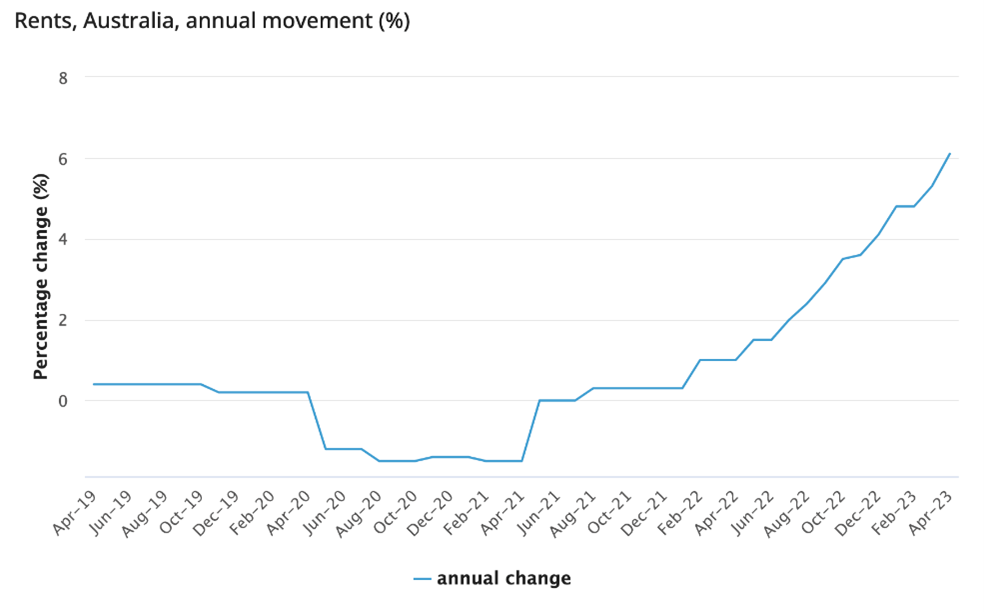

With interest rates on the rise, there is a limited supply of new housing, leading to increased demand for rental properties. As a result, rental prices are expected to continue rising. Currently, rental prices are already increasing by 10 to 20% annually in many cities across Australia, while the CPI figure only shows a bit over 6% in annualized rental growth.

The increase in rents is not showing up on CPI and these will continue to rise, due to under supply and increasing demand. In fact, higher interest rates are going to make it worse and create bigger housing shortage. This is counter to what the RBA wants.

What could the government and RBA be doing to improve the rental market and take pressure off inflation that doesn’t involve increasing interest rates.

- Focus on Increasing Housing Supply: Measures MUST be taken to encourage the construction of more homes. Reallocating labour resources currently engaged in infrastructure projects and incentives for builders and developers will alleviate the undersupply.

- Discounted Fixed Rate Loans for Landlords: Need to reduce rental growth without imposing rental caps. Offering discounted fixed-rate loans to landlords who sign long-term leases with minimal rental increases can help reduce rental growth across the market. This would ease pressure on inflation and eliminate the need for the RBA to increase interest rates. Government incentives or lower interest rates may be necessary to support this initiative

- Re-evaluate Interest Rate Serviceability Buffer: Adjusting the interest rate serviceability buffer can enable more investors to enter the market, leading to increased housing supply and a potential reduction in high rents.

Benefits for Property Investors and Tenants

Implementing these measures would result in increased rental market stability and reduced inflationary pressures.

- Property investors would benefit from rising rents, reduced supply of housing, and increasing demand, leading to higher property prices.

- Tenants, on the other hand, would benefit from improved supply, lower rental growth, and a more balanced housing market.

Conclusion

The decision to raise interest rates by the RBA has unintended consequences for housing construction and rental prices. As fewer homes are built due to rising interest rates, the rental market faces increased pressure and rents are likely to rise further. It is crucial for the government, APRA, and the Reserve Bank to address the housing affordability crisis by implementing strategies that encourage housing construction, support tenants, and promote a more balanced property market.