This article was originally published via The Age.

I was invited alongside CoreLogic’s Tim Lawless to share insights on a pressing topic: negative gearing and its impact on our local WA market, I hope you enjoy it.

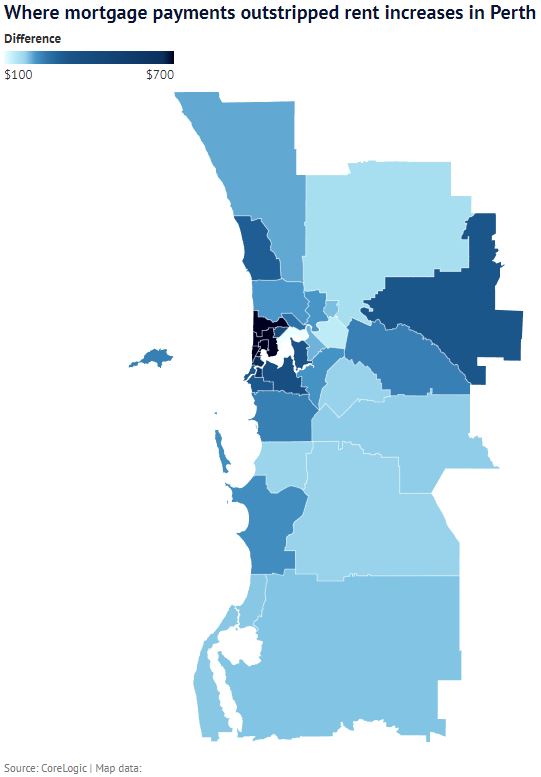

Perth property investors would be hundreds of dollars a week worse off if they bought a property now compared to at the start of the pandemic.

Despite the rental crisis, rents have not risen enough to cover the increase in mortgage repayments in any corner of the city, CoreLogic modelling shows.

The biggest gaps were in affluent spots such as Cottesloe and Peppermint Grove, where the difference between mortgage increases and rent increases is more than $1000 a week.

And the widening gap could leave investors claiming larger tax deductions on negatively geared properties, experts said, increasing the amount of forgone revenue in the federal budget.

Across greater Perth, weekly rents have risen $217 from March 2020 to January 2024, but the typical investor mortgage repayment has risen $424 a week, CoreLogic found.

The highest mortgage repayment increases by council region were in Cottesloe ($1396), Peppermint Grove ($1073) and Nedlands ($989).

The lowest increases were in the City of Perth ($27), Belmont ($132), Swan ($158), and Kwinana ($173).

CoreLogic Australia research director Tim Lawless said while Perth rents have been rocketing higher, the cost of mortgage repayments has also increased substantially over the same period of time.

“For an investor buying into the market at today’s prices the cost of debt has roughly doubled from where it was in March 2020,” he said.

“For most landlords, the cost of holding an investment property has increased a lot more than the increase in rental income, especially for leveraged investors with a high loan balance.

“Given the large increase in mortgage repayment costs for property investors, we are likely to see an increase in landlords utilising a negative gearing strategy, offsetting their cash flow losses against income.”

Negative gearing rules allow investors who pay more interest on a loan than they receive in net rental income to deduct their loss from their salary income to reduce their taxable income.

Matthew Lewison, chief executive at Melbourne-based property investment agency OpenCorp, said a third of all loans being taken out in WA were to purchase an investment property, the highest level since 2013/14.

“The biggest incentive that would encourage more investors to become active, and which would help overcome the housing crisis for renters, is certainty around borrowing requirements and a reduction of the 3 per cent Interest Rate Serviceability Buffer, which APRA requires banks to use in assessing borrowers,” he said.

“Unfortunately, since 2017, banks have been required to assess investors on more stringent criteria and higher interest rates than owner-occupiers.

“This led to a reduction in the number of active property investors across Australia and, in turn, this reduction in investor activity led to fewer new homes being built and fewer rental properties being available.”

Lewison called for the roadblocks that impede “mum-and-dad investors” from entering the investment market to be removed to help boost housing supply.

“There are tens of thousands of investors around Australia who have enough equity to buy a new investment property, and who could service a mortgage, but due to the bank’s assessment criteria they do not qualify for a loan,” he said.

“A 3 per cent buffer was appropriate when interest rates were 2 per cent, but now it appears excessive and is undermining the market by exacerbating the housing undersupply.”

Lawless said the main motivation for investors tended to be capital growth.

“The flipside for property investors is that they are likely to be in a much better wealth position, at least on paper, given the substantial rise in Perth housing values,” he said.

“Since the onset of COVID in March 2020, Perth housing values are up 49.9 per cent, adding approximately $225,000 to the median value of a Perth dwelling.”

Perth home values rose more than $11,000 in January, continuing the capital’s trend of prices rising by more than 1 per cent a month.